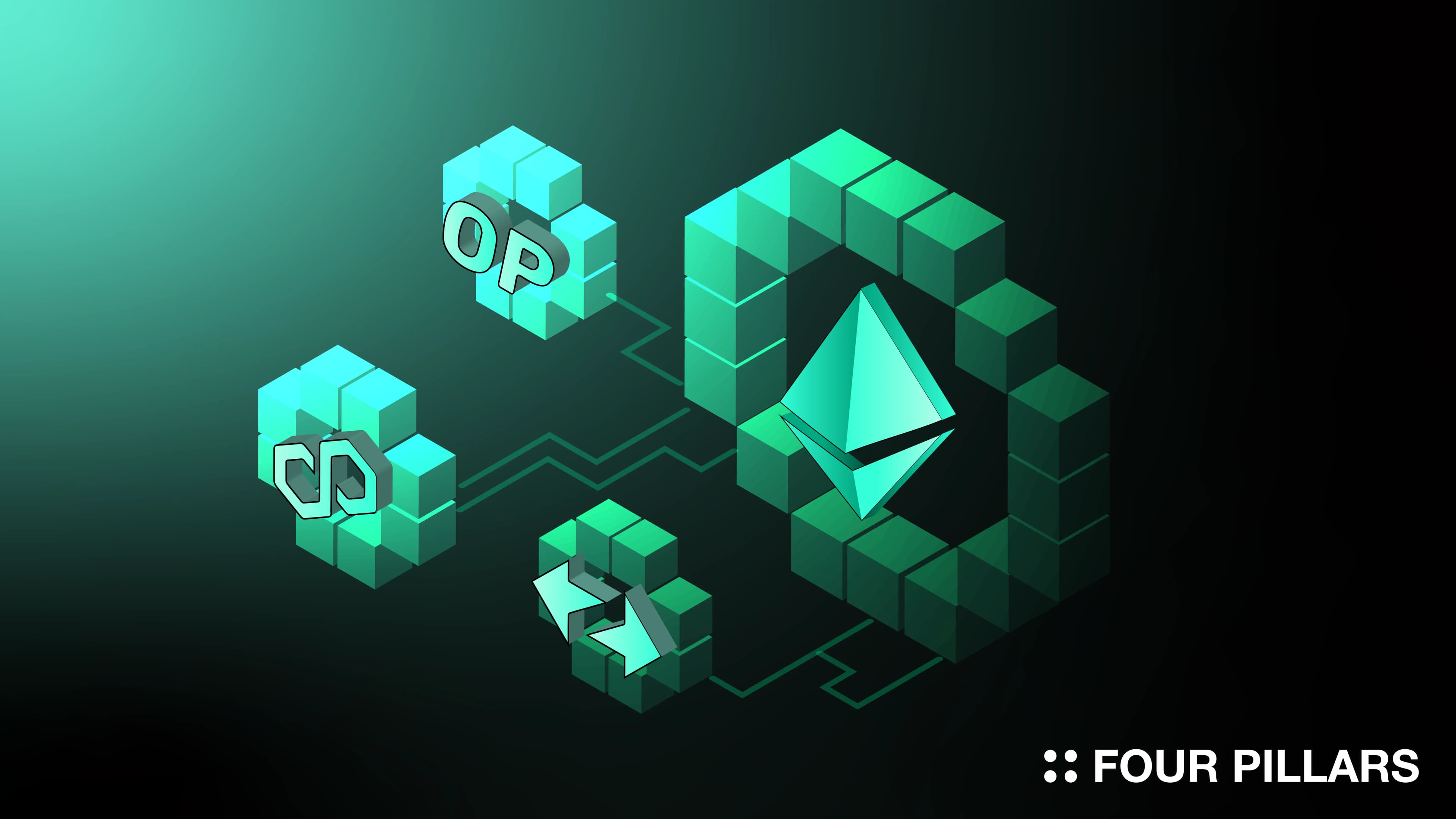

The rapid evolution of Layer 2 (L2) scaling solutions has brought both opportunity and complexity to the Ethereum ecosystem. As rollups multiply, each with its own sequencer infrastructure, the landscape becomes increasingly fragmented. Liquidity silos, operational inefficiencies, and composability barriers threaten the promise of seamless decentralized finance. Enter shared sequencers: a transformative approach aiming to unify transaction ordering, enhance cross-rollup interoperability, and reduce costs for both users and developers.

Rollup Fragmentation: The Challenge Facing L2 Scalability

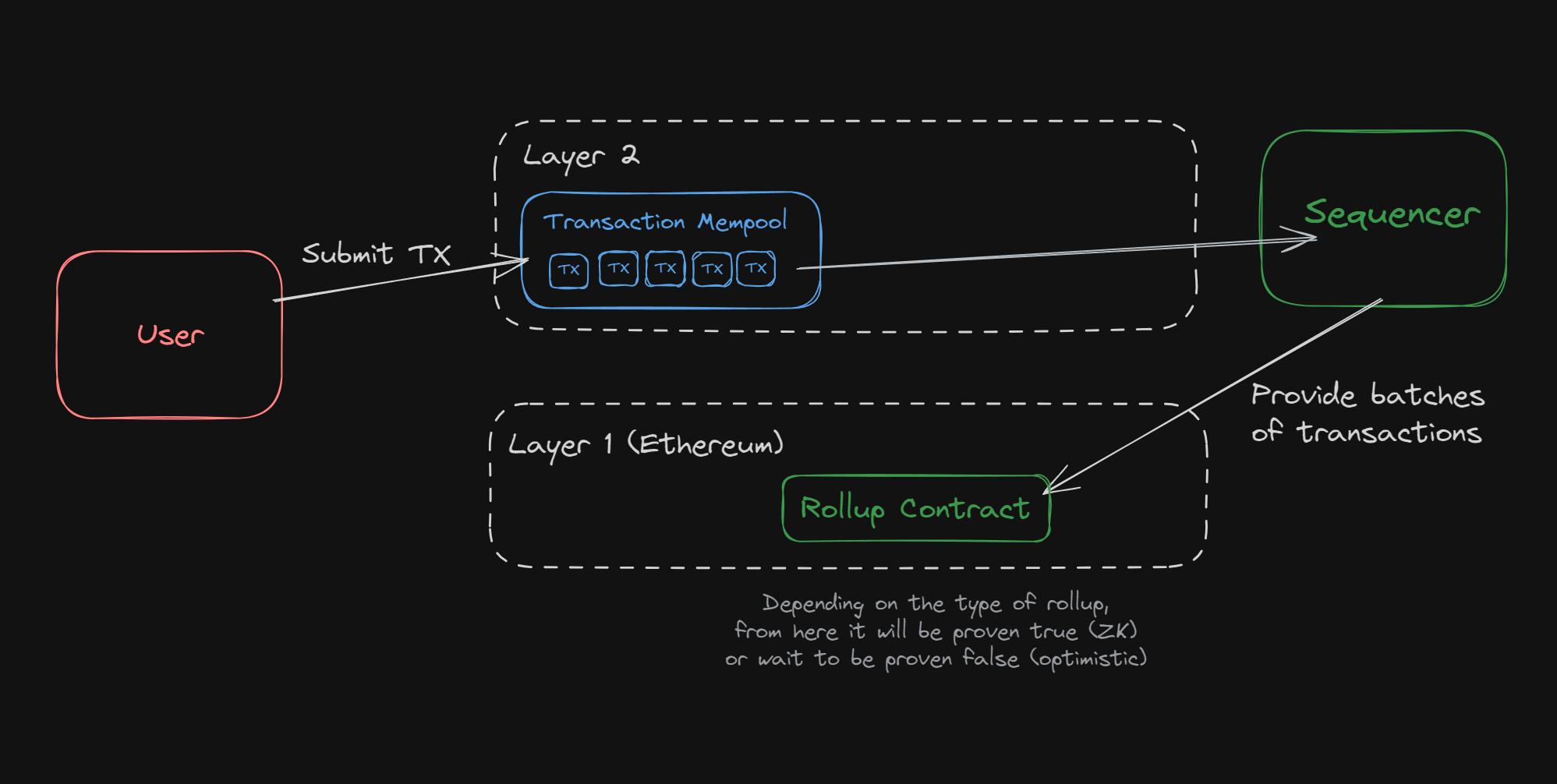

At the heart of Ethereum’s modular scaling vision lies a paradox. While rollups offload computation from Layer 1 (L1), their proliferation introduces new forms of fragmentation. Each rollup traditionally relies on its own sequencer to order transactions before submitting them to L1. This siloed approach creates three core challenges:

- Fragmented liquidity: Assets and activity become trapped within individual rollups, making it difficult for users and dApps to interact across chains without friction.

- Centralization risks: Single-sequencer designs concentrate power, raising concerns about censorship and resilience (source).

- Duplicated infrastructure costs: Each project must maintain its own sequencing stack, inflating operational expenses.

This fragmentation not only hinders user experience but also undermines the network effects that make decentralized ecosystems robust and liquid.

Shared Sequencers: Defragmenting the Rollup Ecosystem

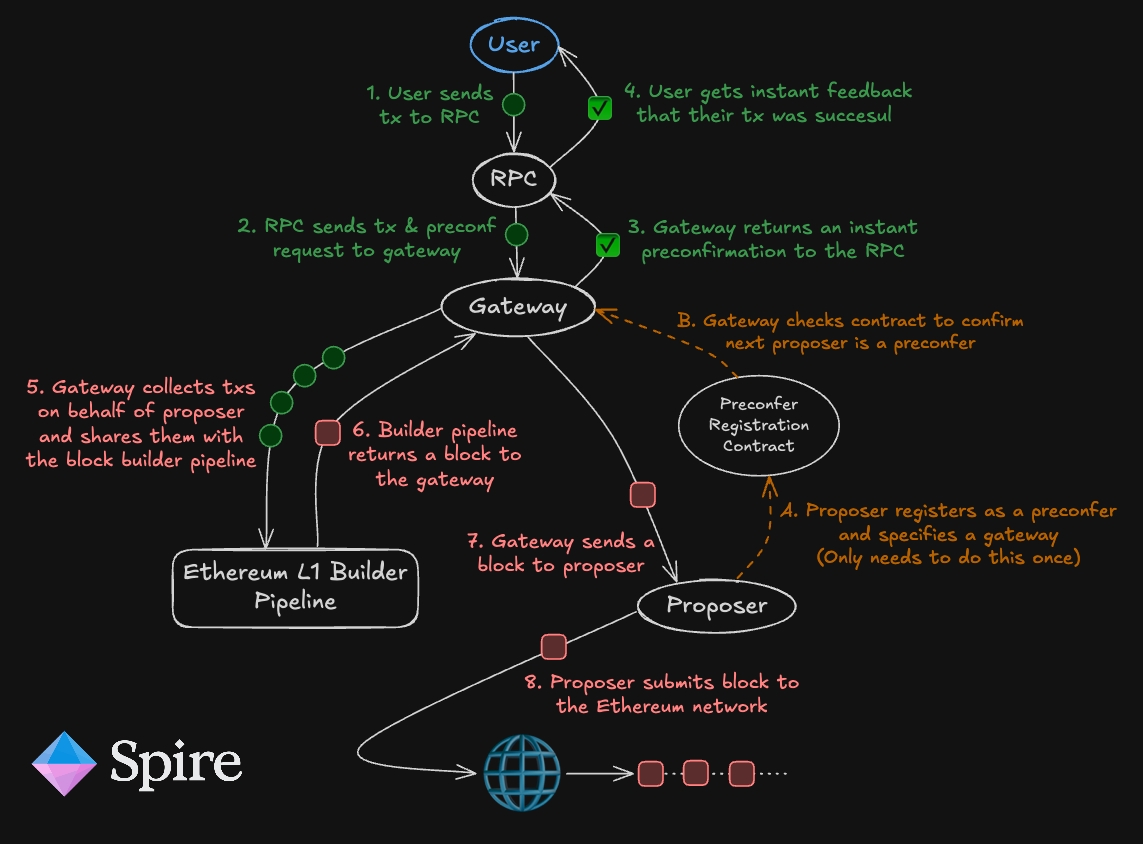

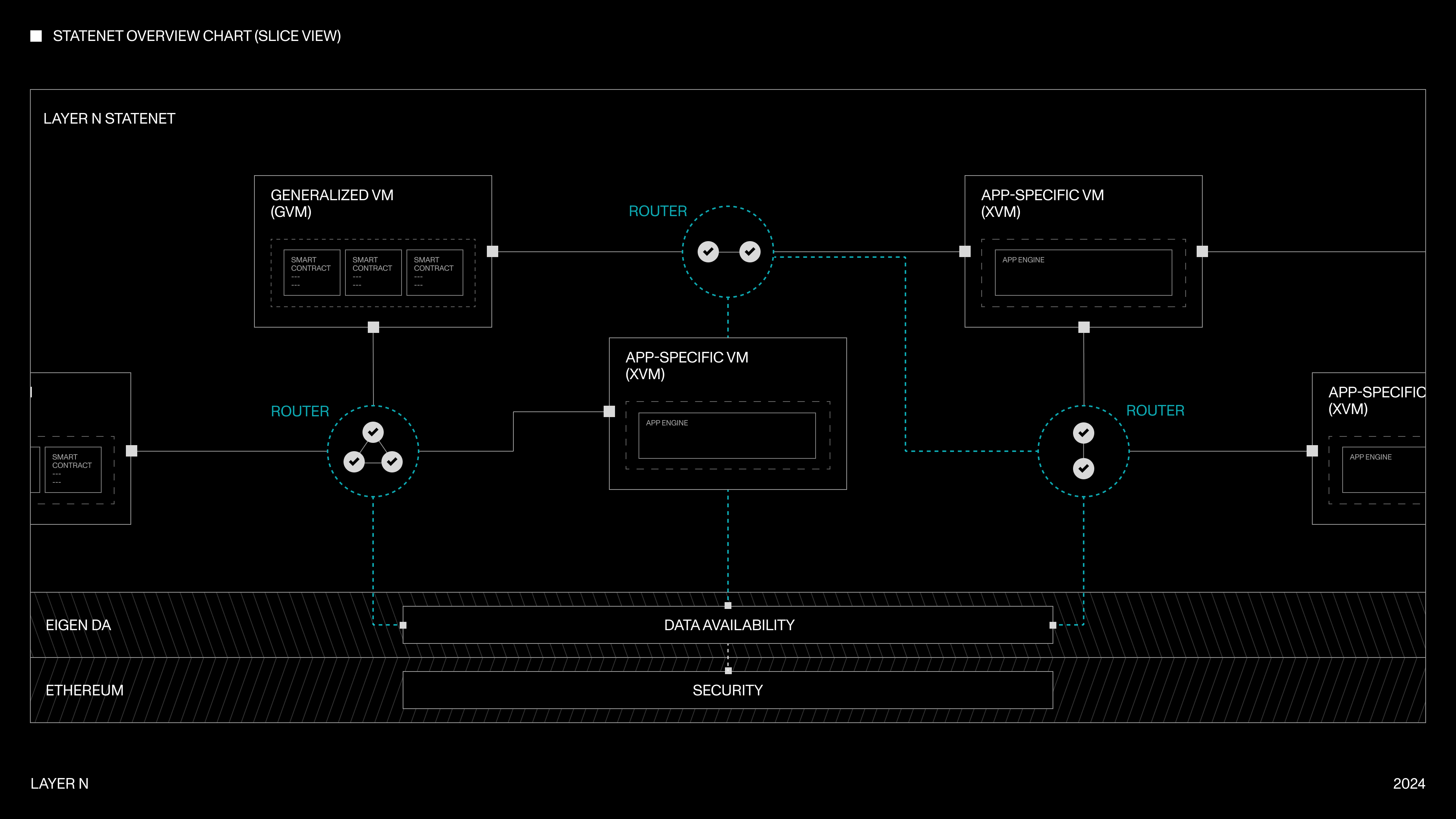

A shared sequencer network is a decentralized set of nodes responsible for ordering transactions across multiple rollups simultaneously. Instead of each L2 running an isolated sequencer, projects can tap into a common sequencing layer that standardizes transaction ordering. This innovation brings several advantages:

Key Benefits of Shared Sequencers for Layer 2 Scalability

-

Enhanced Interoperability: Shared sequencers enable atomic cross-rollup transactions, allowing decentralized applications (dApps) to interact seamlessly across different Layer 2 chains. This reduces liquidity fragmentation and improves user experience. (Trireme Research)

-

Improved Decentralization: By distributing sequencing responsibilities across a network, shared sequencers reduce centralization risks and enhance censorship resistance compared to single-sequencer models. (Dartmouth Blockchain)

-

Cost Efficiency: Pooling resources through a shared sequencer network lowers operational and infrastructure costs for individual rollups, making Layer 2 participation more accessible and sustainable. (Mitosis University)

-

Greater Composability: Standardized transaction ordering across rollups enables more complex and composable DeFi protocols, fostering innovation and cross-chain collaboration. (Medium: Ethereum’s Fragmentation)

-

Scalability for Smaller Projects: Shared sequencers lower entry barriers for new or smaller rollups by providing access to robust sequencing infrastructure without the need for dedicated resources. (Mitosis University)

Enhanced interoperability: With standardized ordering, dApps gain access to atomic cross-rollup transactions, unlocking seamless composability between protocols on different chains (source). Imagine a swap on one rollup automatically triggering a lending action on another without settlement risk or delay.

Improved decentralization: By distributing sequencing duties among many participants, shared networks mitigate single points of failure and censorship vectors (source). This aligns with Ethereum’s ethos of neutrality and resilience.

Transaction cost reduction: Pooling resources allows smaller projects to avoid the overhead of bespoke infrastructure. Batch processing across multiple rollups enables economies of scale, lowering fees for end-users while maintaining high throughput (source).

The Technical Hurdles Ahead: MEV and Atomicity

The promise of shared sequencing is substantial, but implementation is far from trivial. Two technical hurdles stand out:

- Cross-rollup MEV (Maximal Extractable Value): Coordinating transaction flow across multiple chains introduces new opportunities, and risks, for MEV extraction. Without robust mechanisms for fair ordering and auction design, value could be siphoned by sophisticated actors at the expense of regular users (source).

- Atomic execution guarantees: For truly trustless composability, cross-rollup transactions must either execute in full or revert entirely if any leg fails. Achieving this requires advanced coordination protocols that synchronize state transitions between disparate systems (source).

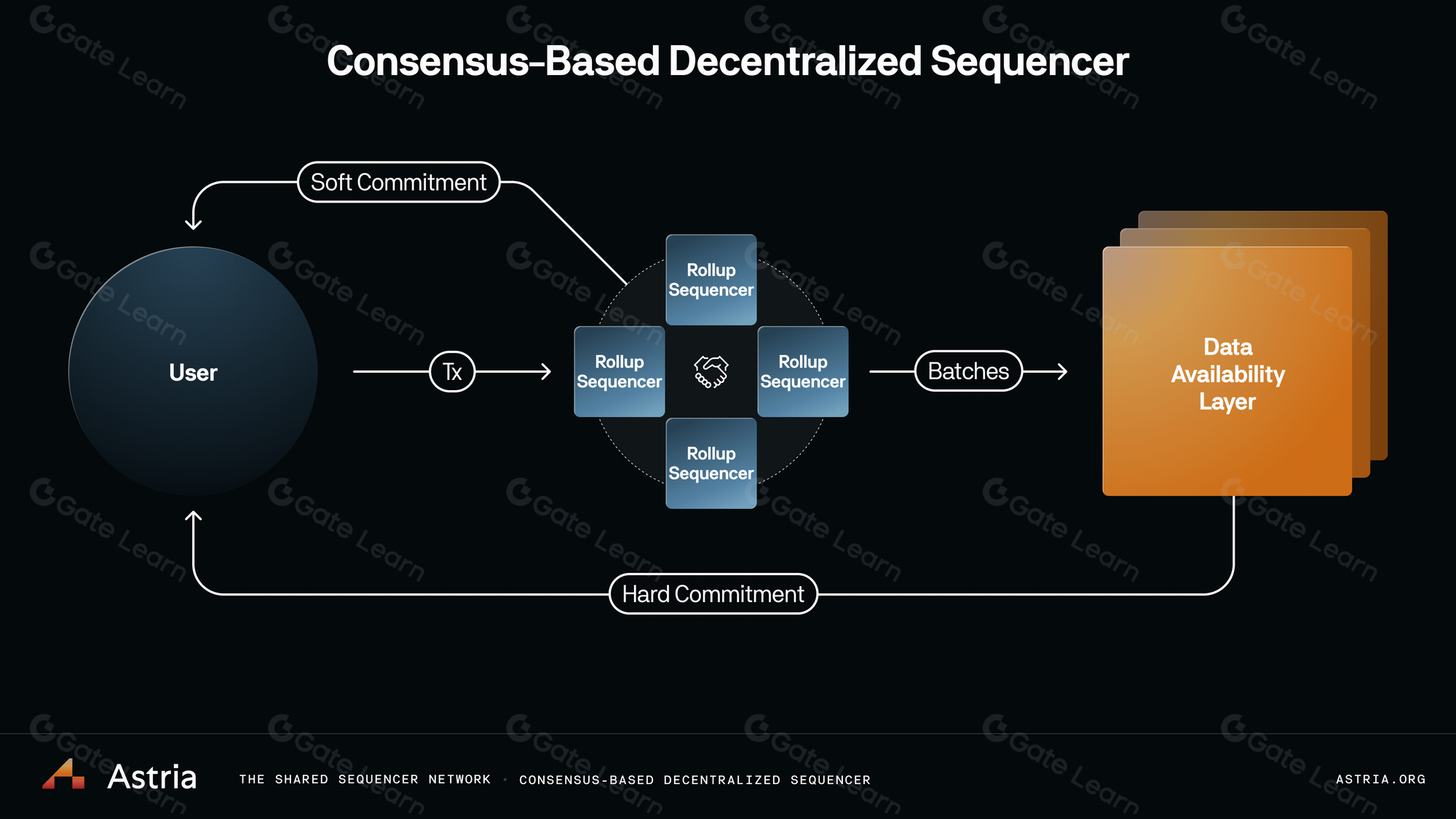

Pioneering projects such as Astria are actively tackling these issues by building decentralized shared sequencer networks designed to maximize security while minimizing friction for developers.

As shared sequencer networks mature, their impact on rollup fragmentation and Layer 2 scalability is becoming increasingly clear. By enabling multiple rollups to share a common transaction ordering layer, these networks address not only technical inefficiencies but also core market dynamics. The result? Lower operational costs, greater flexibility for developers, and a more unified liquidity landscape for users.

Cost Efficiency in Practice: How Shared Sequencers Reduce Transaction Overheads

One of the most tangible benefits of shared sequencing is transaction cost reduction. Instead of each rollup shouldering the expense of standalone sequencer hardware, software maintenance, and uptime guarantees, projects pool resources through a decentralized network. This shared infrastructure model unlocks several efficiencies:

Real-World Cases of Shared Sequencing Lowering L2 Costs

-

Astria Shared Sequencer Network: Astria is pioneering a shared sequencer network that enables multiple rollups to batch transactions together, reducing per-transaction costs by leveraging economies of scale. Early testnet results and community reports indicate significant fee reductions compared to isolated sequencer setups.

-

Espresso Systems: Espresso’s shared sequencing layer is being integrated by several Layer 2 rollups, such as Polygon zkEVM and Caldera, to coordinate transaction ordering. By pooling sequencer resources, these rollups have reported lower operational costs and improved fee efficiency for end users.

-

Radius Shared Sequencer: Radius offers a decentralized shared sequencing service that supports multiple rollups, including projects in the OP Stack ecosystem. By consolidating sequencing infrastructure, participating rollups have observed a measurable decrease in transaction fees and infrastructure overhead.

-

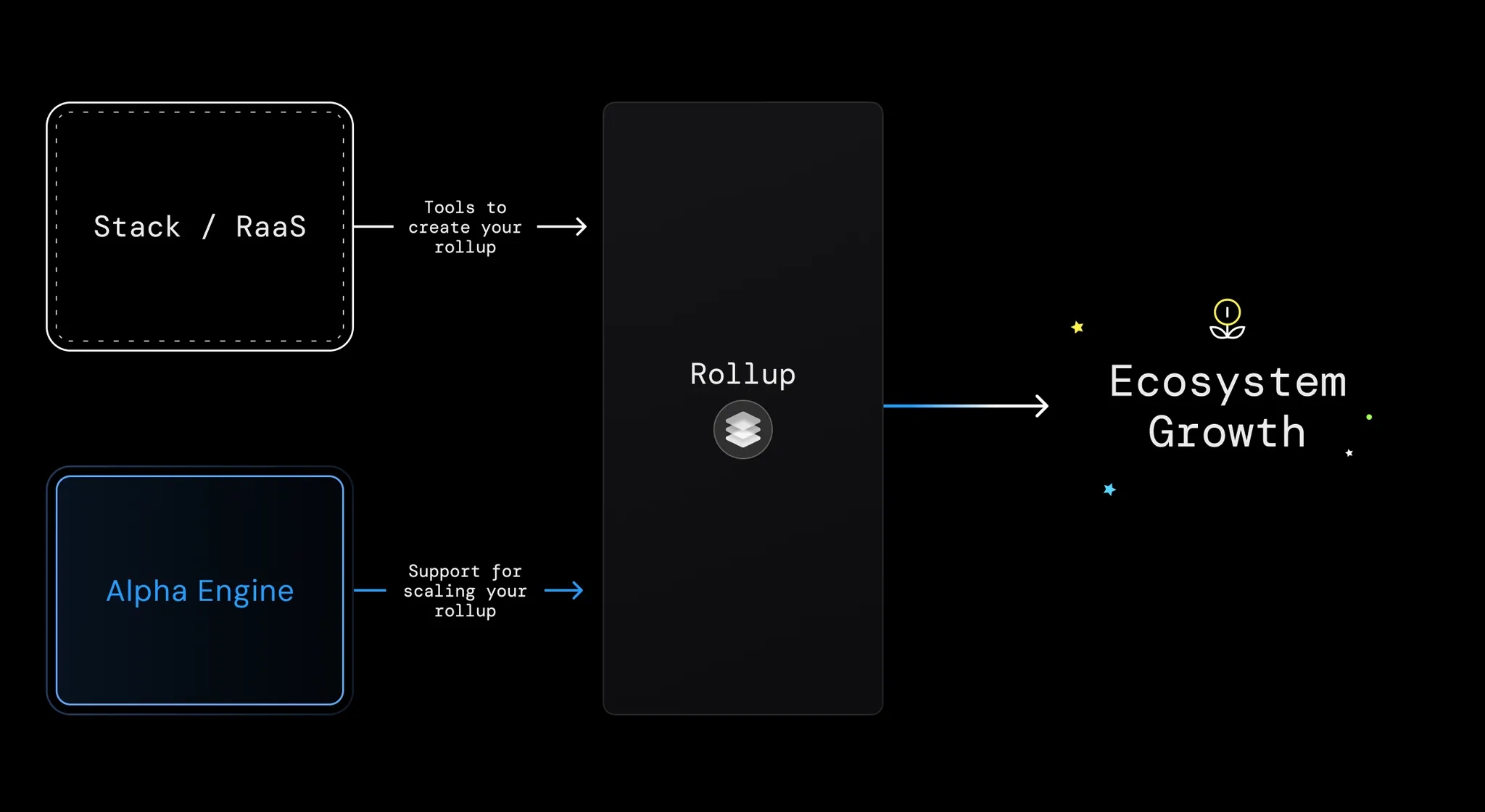

Polygon CDK (Chain Development Kit) with Shared Sequencers: Polygon’s CDK enables developers to launch custom rollups that can opt into shared sequencing. Early adopters have cited reduced transaction costs due to shared batching and minimized duplication of sequencer operations.

-

Caldera Rollups Using Shared Sequencers: Caldera, a platform for launching customizable rollups, integrates shared sequencing solutions to allow its rollups to batch transactions together. This approach has led to lower user fees and improved cost efficiency for dApps deployed on Caldera-powered chains.

Batching and compressing transactions across multiple rollups means more data can be packed into each L1 submission, amortizing base layer fees over a wider set of users. For emerging protocols and smaller dApps, this levels the playing field, enabling participation in Ethereum’s scaling ecosystem without prohibitive upfront investment.

Moreover, as different Data Availability (DA) layers compete on price and performance (source), shared sequencer networks can dynamically select the most cost-effective DA option for each batch. This flexibility further drives down average costs per transaction while maintaining robust security guarantees.

Composability Unlocked: The Future of Interconnected dApps

The true power of shared sequencers lies in their ability to enable atomic cross-rollup transactions. With standardized ordering and synchronized state transitions, developers can design applications that bridge assets and logic across multiple chains without settlement risk or manual coordination. This is a foundational leap for DeFi composability, one that could see liquidity pools spanning several rollups or complex derivatives built atop interconnected primitives.

Of course, challenges remain. Ensuring fair access to sequencing slots, preventing MEV exploitation across chains, and achieving reliable atomicity are active areas of research. Yet early deployments, such as those led by Astria, demonstrate that decentralized sequencing is not just feasible but already delivering concrete benefits to builders and users alike (source).

The Road Ahead: Adoption and Ecosystem Integration

The next phase for shared sequencers will be defined by adoption rate among leading rollups and integration with major DA providers. As standards emerge around transaction ordering APIs and cross-rollup communication protocols, expect to see an explosion of composable dApps that treat the entire L2 landscape as a single fluid environment rather than a patchwork of silos.

This shift will likely accelerate innovation at both the application layer, where new financial primitives become possible, and at the infrastructure level, where competition between sequencer networks drives further cost reductions and reliability improvements.

The promise of modular blockchains was always about flexibility without fragmentation. Shared sequencers represent a decisive step toward realizing that vision, delivering scale, efficiency, and composability while preserving Ethereum’s core values.