Choosing between Optimistic rollups and ZK rollups is a pivotal decision for any team planning app-chain deployment. Both technologies offer significant advances in blockchain scalability, but each brings distinct trade-offs in speed, cost, compatibility, and privacy. Understanding these differences is crucial to align your infrastructure with your project’s goals.

How Optimistic Rollups Work: Efficiency and Flexibility

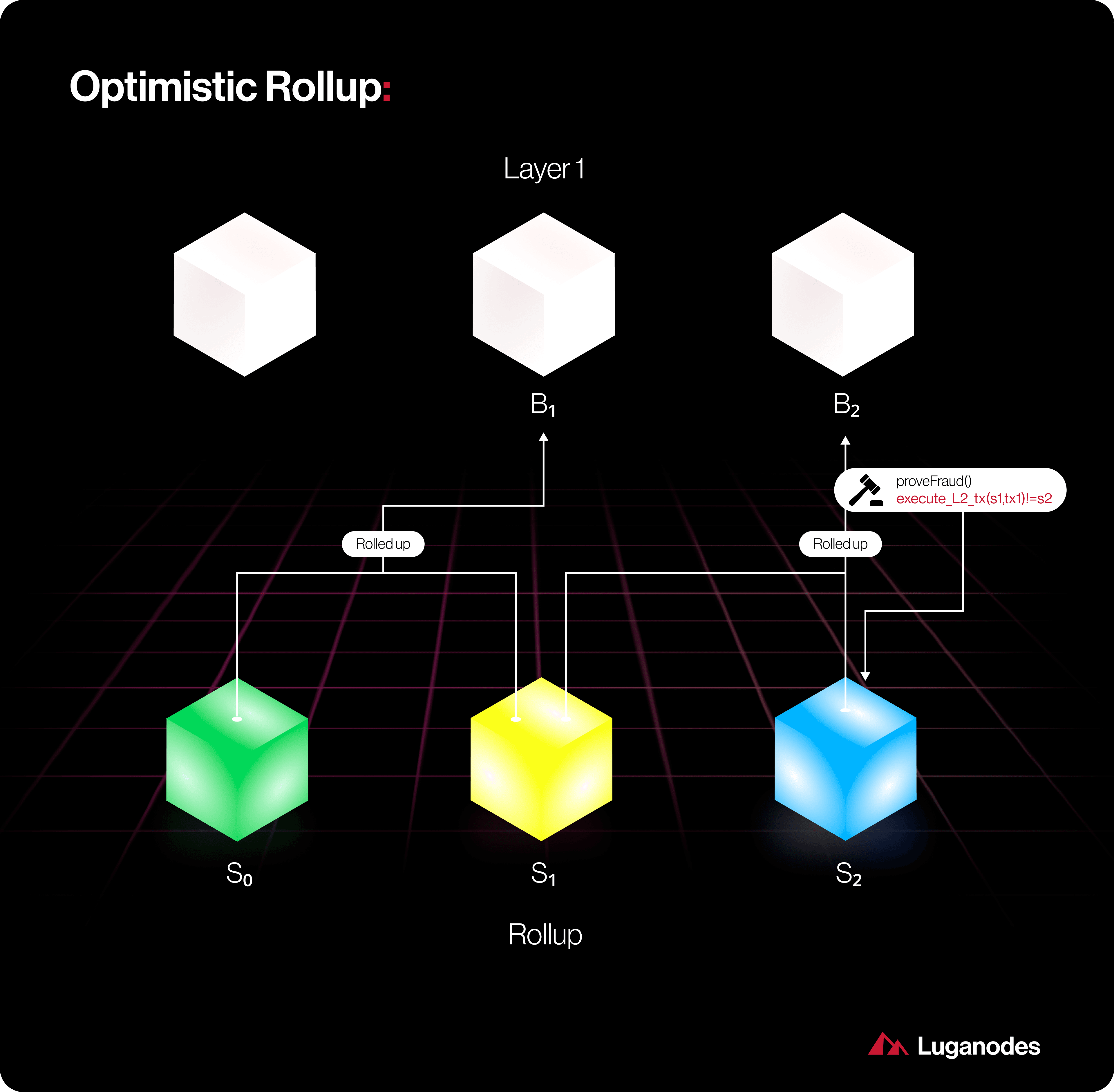

Optimistic rollups operate under an assumption: all transactions are valid unless proven otherwise. This approach allows them to batch hundreds or thousands of transactions off-chain and submit a single aggregated proof to the main blockchain. The key mechanism is the challenge period, typically up to seven days, during which anyone can contest a transaction by submitting a fraud proof. If no valid challenge arises, the transaction batch is finalized.

This structure has several practical advantages:

- High throughput: By deferring validation unless challenged, optimistic rollups can process large volumes of activity quickly.

- Straightforward deployment: They support general-purpose logic and are highly compatible with existing Ethereum smart contracts. This makes them ideal for complex dApps, especially in DeFi.

- Lower operational costs: Since no validity proofs are required upfront, gas fees tend to be lower than ZK alternatives.

The main drawbacks? The challenge period means withdrawals can be slow – often taking several days – and there remains a dependency on vigilant actors to spot fraudulent transactions promptly. For some use cases, such as high-frequency trading or instant settlements, this delay may be unacceptable.

ZK Rollups: Speed and Privacy at a Computational Cost

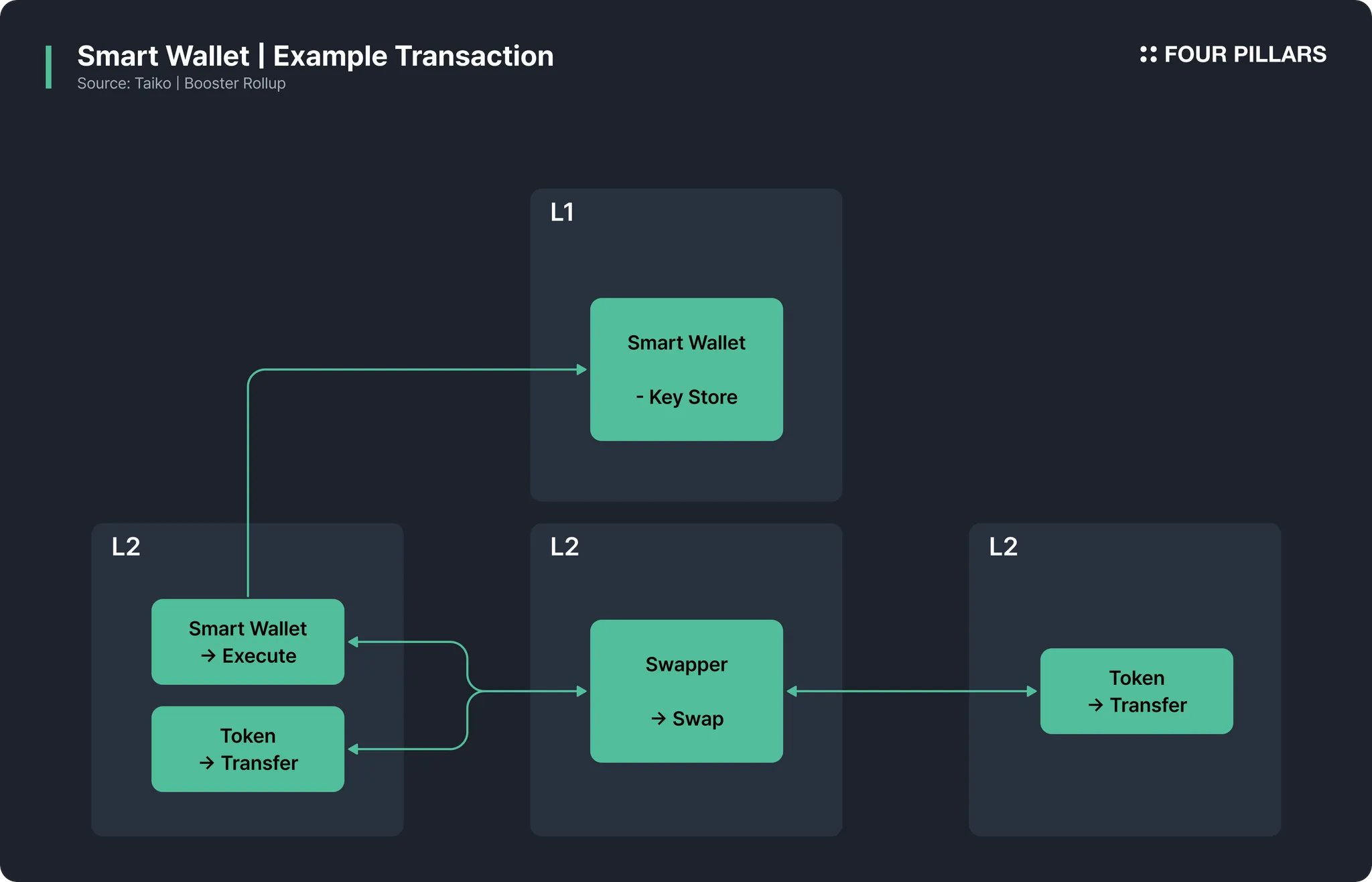

ZK rollups take a fundamentally different approach. Every batch of transactions is accompanied by a succinct cryptographic proof (a zero-knowledge proof) that attests to its validity before it’s submitted on-chain. This means transactions are verified instantly, offering near-immediate finality without waiting for challenge periods.

The benefits here are substantial:

- Fast finality: No need for dispute windows – users can withdraw assets within minutes.

- Enhanced privacy: Zero-knowledge proofs can shield sensitive transaction details from public view while still proving correctness.

- No reliance on challengers: Security derives directly from cryptography rather than network vigilance.

The catch? Generating these proofs is computationally intensive and can lead to higher costs for operators. Additionally, ZK rollup environments may not support all Ethereum smart contract functionalities out-of-the-box; developers might need to adapt or rewrite parts of their codebase for compatibility (source). This adds complexity, especially for teams without deep expertise in cryptography or protocol development.

Key Differences: Optimistic vs ZK Rollups for App-Chains

-

Transaction Finality: ZK Rollups offer near-instant finality by validating transactions with zero-knowledge proofs before submission, while Optimistic Rollups require a challenge period (often up to 7 days) before transactions are finalized.

-

Cost Efficiency: Optimistic Rollups generally have lower operational costs since they avoid the computationally intensive process of generating zero-knowledge proofs required by ZK Rollups.

-

Smart Contract Compatibility: Optimistic Rollups maintain high compatibility with existing Ethereum smart contracts, enabling easier migration and deployment. ZK Rollups may require contract adaptation due to limited support for complex logic.

-

Privacy: ZK Rollups enhance privacy by using cryptographic proofs that verify transaction validity without revealing underlying data. Optimistic Rollups do not provide this level of confidentiality.

-

Development Complexity: ZK Rollups demand more advanced cryptographic expertise and development resources, whereas Optimistic Rollups are generally easier to implement and integrate for most teams.

Selecting the Right Rollup Technology for Your App-Chain

Your choice should be driven by your application’s unique requirements. Consider these guiding questions as you evaluate options:

- Does your app require instant transaction finality?

- Is seamless Ethereum smart contract compatibility essential?

- Are operational costs or technical complexity bigger constraints?

- How important is privacy for your users?

If rapid settlement times or privacy features top your list, ZK rollups may be worth the additional complexity and expense. If you prioritize ease of deployment and broad compatibility with existing dApps or DeFi protocols, Optimistic rollups could be more suitable (source). Ultimately, both technologies represent major steps forward in blockchain scalability; the best fit depends on how you weigh speed against cost, flexibility against privacy.

For teams navigating the expanding landscape of rollup technology, it’s worth noting that the field is evolving rapidly. New frameworks and toolkits, like OP Stack for Optimistic rollups and ZK Stack for ZK rollups, are lowering barriers to entry, but each still demands careful evaluation of trade-offs. The decision isn’t simply technical; it’s also about aligning with your project’s growth trajectory, user expectations, and resource allocation.

Real-World Scenarios: When to Choose Each Rollup

Let’s look at practical scenarios. Suppose you’re launching a DeFi protocol that depends on composability with existing Ethereum smart contracts and anticipates high transaction volumes. In this case, Optimistic rollups offer a smoother path to mainnet, lower upfront development costs, and a user experience that mirrors Ethereum L1, minus the congestion. However, if your application involves gaming or NFT marketplaces where instant withdrawals and privacy are key differentiators, ZK rollups can deliver a superior experience despite higher operational overhead.

The competitive landscape is also shifting as both rollup types mature. Recent advances in ZK proof generation have started to close the cost and speed gap with optimistic solutions. Meanwhile, Optimistic rollups are experimenting with shorter challenge windows and improved fraud detection to minimize withdrawal delays. The result: an increasingly nuanced choice set where the right answer may change as technology advances.

Comparing Deployment and Ecosystem Support

Deployment timelines can be decisive for startups or enterprises racing to market. Optimistic rollups remain easier to deploy today, especially when leveraging established frameworks like OP Stack or Arbitrum Orbit (source). Their mature tooling means less friction for teams without deep cryptography expertise. By contrast, ZK rollup deployments often require custom engineering and a steeper learning curve but offer unique advantages in privacy-centric or high-frequency use cases.

Ecosystem support is another factor: both rollup types now enjoy robust developer communities, but compatibility layers for ZK environments are improving fast. As more open-source libraries emerge, and as EVM-compatible ZK solutions become mainstream, the calculus may tilt further toward ZK for some projects.

Summary Table: Rollup Technology Comparison

Optimistic vs ZK Rollups: Feature Comparison for App-Chain Builders

| Feature | Optimistic Rollups | ZK Rollups |

|---|---|---|

| Transaction Validation | Assume transactions are valid by default; fraud proofs only submitted if challenged | Transactions validated upfront using zero-knowledge proofs |

| Finality Speed | Slower (challenge period, typically up to 7 days) | Faster (often within minutes, no challenge period) |

| Cost Efficiency | Generally lower operational costs (no complex cryptography) | Higher operational costs (computationally intensive proof generation) |

| Smart Contract Compatibility | High; supports existing Ethereum smart contracts with minimal changes | Limited; may require adaptation or rewriting of contracts |

| Privacy | Standard; no extra privacy features | Enhanced; zero-knowledge proofs provide transaction confidentiality |

| Deployment Flexibility | Easier and faster to deploy; suitable for general-purpose dApps | Requires specialized knowledge; more complex to implement |

| Security Model | Relies on fraud proofs and challenge periods | Relies on cryptographic validity proofs |

| Best Use Cases | DeFi platforms, general-purpose dApps needing Ethereum compatibility | Apps requiring fast finality and privacy, e.g., payments or private transactions |

The bottom line? There’s no universal best answer, only what fits your needs today while allowing flexibility tomorrow. Both Optimistic and ZK rollups are powerful tools for blockchain scalability; the right choice depends on your priorities across speed, cost efficiency, privacy requirements, smart contract compatibility, and available development resources.

If you’re ready to deploy your own app-chain but want expert guidance through these decisions, platforms like Rollup-As-A-Service by abstractwatch. com can help you navigate this complexity, letting you focus on innovation while we handle the infrastructure.