The rapid evolution of Ethereum’s scaling landscape has brought rollups like Arbitrum and Optimism to the forefront, dramatically increasing transaction throughput and lowering costs. As of September 19,2025, Ethereum trades at $4,476.08, reflecting both the platform’s resilience and the surging demand for scalable decentralized applications (dApps). Yet beneath this success lies a pressing challenge: liquidity fragmentation. As assets and users disperse across an expanding array of rollups and app-chains, cross-chain dApp development faces mounting complexity, threatening the very composability that made DeFi revolutionary.

Liquidity Fragmentation: The Hidden Cost of Rollup Proliferation

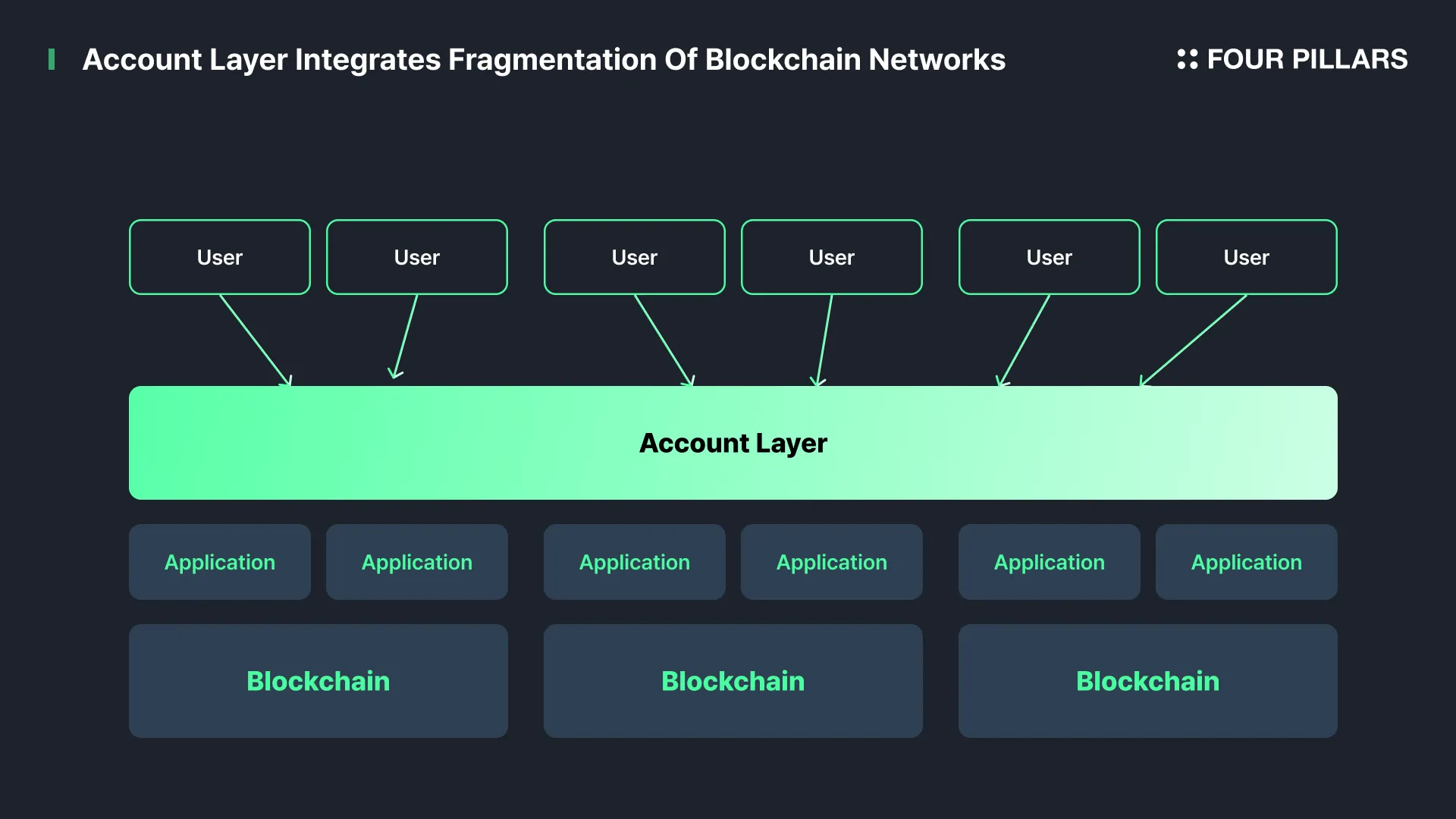

Liquidity fragmentation occurs when tokens are scattered across multiple rollups, undermining efficient trading pairs, reducing yield opportunities for lending protocols, and complicating user experience. Instead of a unified liquidity pool where capital flows freely, developers and users must contend with isolated silos, each with its own wallets, interfaces, and settlement mechanisms. This not only increases friction but also erodes the network effects critical to decentralized finance.

Recent analysis from Scroll underscores three primary pain points:

- User Complexity: Managing multiple wallets and interfaces is cumbersome for non-technical users.

- Inefficient Liquidity: Dispersed assets result in suboptimal trading prices and lower yields.

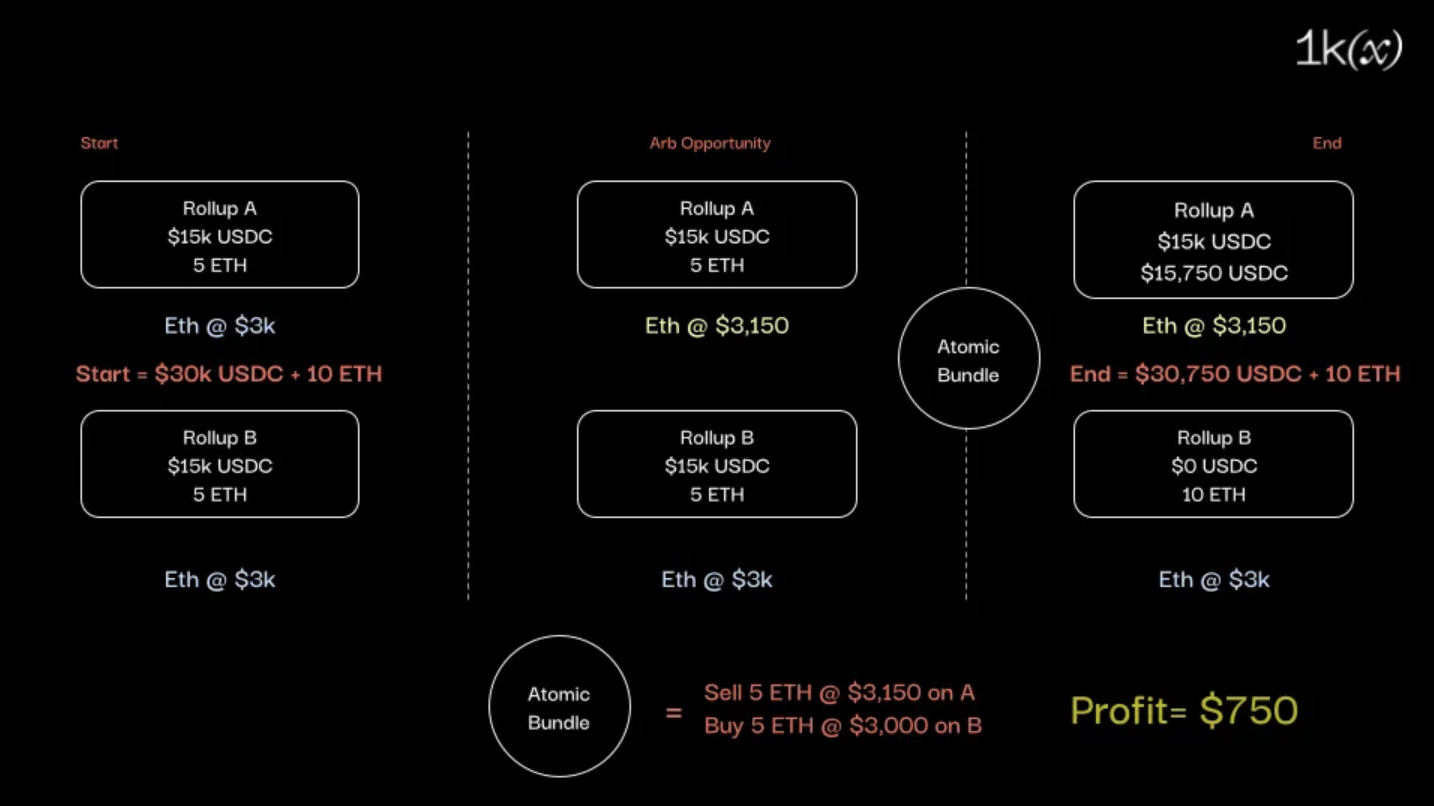

- Broken Composability: Atomic interactions, like flash loans or multi-step swaps, become nearly impossible across fragmented rollups.

Key Challenges for Cross-Chain dApp Developers

-

Liquidity Fragmentation: Assets are dispersed across multiple rollups, resulting in inefficient trading pairs, reduced yields for lending protocols, and less effective capital utilization throughout the ecosystem.

-

User Experience Complexity: Users must manage multiple wallets and interfaces across different rollups, increasing friction and making onboarding and everyday interactions more cumbersome.

-

Limited Cross-Rollup Composability: The lack of atomic, immediate interactions between rollups undermines composability, restricting the ability to build powerful, interconnected DeFi and Web3 applications.

-

Inconsistent State Management: Maintaining consistent token and contract states across rollups is technically challenging, leading to potential transaction conflicts and security risks.

-

Fragmented Standards and Protocols: Each rollup or modular chain may define its own standards and messaging protocols, complicating interoperability and increasing the development overhead for cross-chain dApps.

The Push for Abstract Rollup Interoperability

The blockchain industry is rallying around abstract rollup interoperability as a solution to these entrenched issues. Unlike traditional bridges or message-passing protocols, which often introduce new trust assumptions or security risks, abstract interoperability frameworks aim to unify liquidity and state across chains at a fundamental level. The goal: empower developers to build truly cross-chain dApps without forcing users to grapple with fragmentation behind the scenes.

A wave of innovative solutions is emerging in this space:

- UAT20: A universal abstract token standard leveraging CRDTs (Conflict-free Replicated Data Types) for consistent states across rollups. It utilizes a two-phase commit protocol to resolve conflicts securely, a major step toward unified liquidity pools. (arxiv.org)

- CRATE: A protocol enabling secure all-or-nothing execution of cross-rollup transactions, even between different L1s, by ensuring atomic finality in four L1 rounds. (arxiv.org)

- LayerZero: A trustless omnichain protocol facilitating direct transactions between any chains without custodians or intermediaries, consolidating fragmented liquidity into seamless user experiences. (arxiv.org)

- Omnichain Web and Entangled Rollups: Advanced frameworks leveraging recursive zkVMs (zkMIPS) or universal abstraction layers to enable secure asset settlement and state synchronization across sovereign chains without reliance on bridges.

The Developer Opportunity: Building Cross-Chain dApps Without Fragmentation

This new paradigm opens doors for developers leveraging platforms like Rollup-As-A-Service (RaaS). By integrating abstract interoperability protocols at the infrastructure level, RaaS providers empower teams to focus on application logic rather than wrestling with fragmented standards or liquidity silos. The result: cross-chain dApps that offer seamless UX while tapping into global liquidity, no matter where value resides.

The future of Web3 hinges on making chain boundaries invisible, for both users and developers alike.

This shift is not just technical, it’s strategic. Projects that embrace abstract rollup interoperability will be best positioned to capture network effects as capital migrates toward platforms offering superior composability and user-centric design.

At the same time, abstract rollup interoperability is driving a profound rethink of liquidity management and dApp architecture. With protocols like UAT20 and CRATE, developers can design applications where users interact with pooled liquidity across multiple rollups without ever leaving their native interface. This is a fundamental departure from legacy bridge-based models, which often expose users to security vulnerabilities or require cumbersome asset wrapping.

Concrete Gains: Reducing Friction and Unlocking Capital

The impact of these innovations is already visible across the ecosystem. For instance, Scroll’s research highlights how mesh-based approaches to interoperability can unify user experience and liquidity, reducing slippage and boosting yields for DeFi protocols. Meanwhile, trustless frameworks like LayerZero eliminate the need for centralized custodians or multi-hop bridging, directly addressing both user friction and systemic risk.

Importantly, these advances also benefit market efficiency. As noted in recent arXiv studies on FluxLayer and similar architectures, high-performance cross-chain layers enable better arbitrage opportunities and lower transaction costs by aggregating fragmented markets into a single accessible pool. This not only strengthens price discovery but also makes it easier for new protocols to attract capital without reinventing the wheel for each rollup environment.

What’s Next: Toward Seamless Cross-Chain UX

As Ethereum holds strong at $4,476.08, the urgency to solve fragmentation grows alongside rising adoption. The next wave of cross-chain dApps will be defined not just by scalability or throughput but by their ability to abstract away complexity entirely. Users should be able to interact with any asset or protocol, on any chain, as easily as using a single app, regardless of where their funds are parked.

- Universal wallets: Single interfaces that aggregate balances from all connected rollups.

- Composable smart contracts: Protocols that trigger actions across chains atomically without manual bridging.

- Unified governance: Voting mechanisms that span multiple rollups in real time.

The developer ecosystem is rapidly aligning around these goals. Platforms like Rollup-As-A-Service (RaaS) are becoming foundational tools for teams seeking robust abstraction without sacrificing performance or security. By offering modular integration with leading interoperability standards, RaaS solutions help projects sidestep technical debt while remaining agile in a fast-evolving landscape.

The net result? A more connected blockchain universe where capital efficiency improves, composability returns to center stage, and innovation accelerates unbounded by artificial silos. As abstract rollup interoperability matures from research into production-grade infrastructure, expect the boundaries between chains to blur, and with them, many of today’s pain points will quietly disappear.