In the fast-paced world of blockchain startups, launching an app-chain shouldn’t feel like scaling a sheer cliff. Yet, many teams hit rollup infrastructure bottlenecks that drain resources and delay go-to-market timelines. With Ethereum humming at $2,938.34, the pressure to deliver scalable Layer 2 solutions has never been higher. Rollups promise cheap, fast transactions, but building them from scratch? That’s where dreams meet harsh reality.

Market data paints a clear picture: the Rollups-as-a-Service (RaaS) sector is exploding, projected to grow massively through 2032 according to Intel Market Research. Startups chasing app chain deployment are wise to pay attention. Traditional rollup setups demand deep expertise in node management, sequencer ops, and verifier integrations. One misstep, and you’re nursing downtime instead of nurturing users.

Sovereign Rollups’ State Sync Nightmare

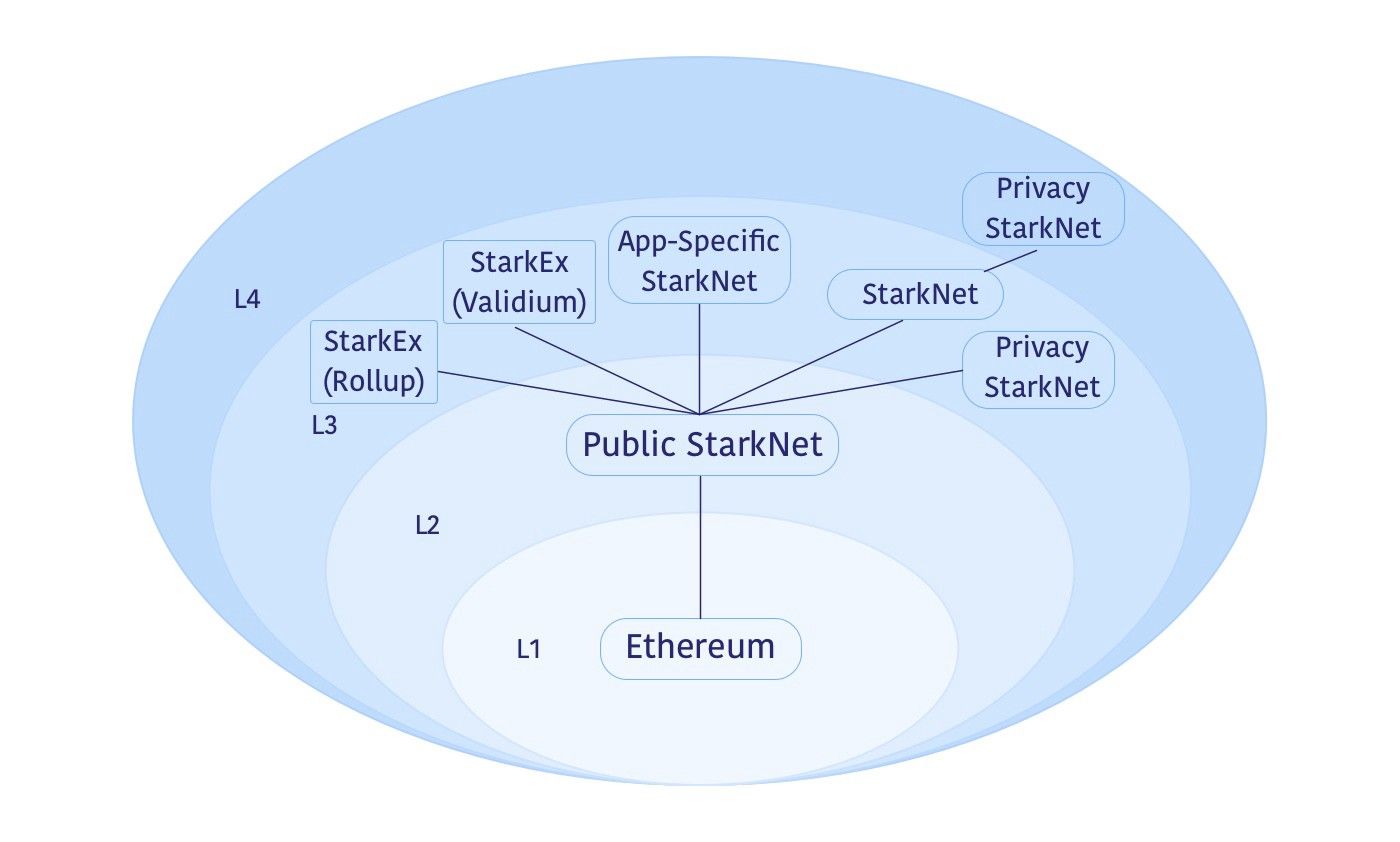

Sovereign rollups sound empowering – full control without a canonical Layer 1 bossing you around. But ChainScore Labs nails it: this freedom breeds a state synchronization crisis. Fragmented ecosystems mean verifying state updates turns into a guessing game. No shared truth? Good luck with secure, timely proofs. Startups end up cobbling together custom bridges, only to face delays and exploits.

I’ve charted enough on-chain chaos to know: without robust tooling, your rollup becomes a silo. Liquidity fragments across chains, as Gate. com highlights in their Layer 2 deep dive. Users hate hopping ecosystems; they want seamless flow. And with ETH at $2,938.34 holding steady despite a slight 24-hour dip, volatility amplifies these pains. Teams waste months on rollup development challenges, diverting focus from killer apps.

Deployment Drudgery: The Hidden Costs of DIY Rollups

Picture this: your blockchain startup has a breakthrough DeFi protocol or NFT marketplace ready to roll. But rollup infrastructure bottlenecks strike. Setting up sequencers, provers, and daemons? It’s a full-time job for a dev army you don’t have. Zeeve’s analysis shows RaaS evolved from niche 2023 experiment to 2025 must-have because it skips this grind.

Self-managing means wrestling modular rollup tooling – think OP Stack tweaks or zkEVM customizations. Alchemy’s guide on scalable custom rollups admits even top teams lean on RaaS for affordability and speed. Vendor lists from LinkedIn and Vocal. media spotlight providers easing app chain deployment, yet pitfalls lurk: vendor lock-in, centralization risks. Instanodes-style platforms offer zk and optimistic flavors across Ethereum, Polygon, BSC, but proprietary stacks can trap you.

Startups I’ve advised often underestimate ops overhead. Sequencer failures? Black swan events halt everything. QuickNode’s Web3 builder guide stresses strategies for high-performance launches, but why reinvent when RaaS handles it? Outlook India calls it a revolutionary demystifier of complexity.

Ethereum (ETH) Price Prediction 2027-2032

Projections Aligned with Rollups-as-a-Service (RaaS) Market Growth and Ethereum L2 Scaling Advancements

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $3,500 | $5,000 | $7,500 | +67% |

| 2028 | $5,000 | $7,500 | $11,000 | +50% |

| 2029 | $6,500 | $10,000 | $15,000 | +33% |

| 2030 | $9,000 | $14,000 | $21,000 | +40% |

| 2031 | $12,000 | $18,000 | $27,000 | +29% |

| 2032 | $15,000 | $22,000 | $33,000 | +22% |

Price Prediction Summary

Ethereum’s price is forecasted to experience robust growth from 2027 to 2032, fueled by the RaaS market expansion that resolves rollup deployment bottlenecks, enhances scalability for app-chains, and boosts L2 adoption. Average prices are projected to rise from $5,000 in 2027 to $22,000 by 2032, with bullish scenarios reaching $33,000 amid favorable market cycles, tech upgrades, and regulatory tailwinds, while bearish cases hold above $15,000 supported by Ethereum’s ecosystem dominance.

Key Factors Affecting Ethereum Price

- RaaS market surge simplifying custom rollup deployments on Ethereum, driving L2 TVL and activity

- Resolution of infrastructure bottlenecks like state sync crises and liquidity fragmentation

- Ethereum’s leadership in modular blockchains with zk and optimistic rollups

- Increased institutional inflows from scalability improvements and clearer regulations

- Market cycle recoveries post-2026, aligned with BTC halvings and macro trends

- Risks from RaaS centralization/vendor lock-in balanced by multi-provider competition

- Broader Web3 adoption accelerating ETH demand as settlement layer

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Embracing Abstract Rollup Technology via RaaS

Enter Rollup-As-A-Service from abstractwatch. com – our abstract rollup technology flips the script for blockchain startup rollups. We streamline everything: deploy customizable, secure rollups without infrastructure headaches. Robust docs, expert support, 99.99% uptime – focus on innovation, not servers.

Unlike rigid providers, our platform sidesteps lock-in with open standards and migration paths. Updated 2026 insights confirm RaaS cuts deployment time dramatically, letting startups launch high-performance networks fast. Check our step-by-step guide for proof. Ethereum’s resilience at $2,938.34 underscores why scalable L2s are non-negotiable now.

Teams switching to RaaS report 10x faster iterations. No more state sync woes or liquidity silos; built-in sequencers and cross-chain tools keep things fluid. For startups eyeing rollup as a service, it’s the smart pivot from bottlenecks to breakthroughs.

Quantifying the shift makes it even clearer. Intel Market Research forecasts the RaaS market surging through 2032, fueled by demands for scalable setups amid Ethereum’s steady $2,938.34 price point. Startups ditching DIY rollups reclaim dev hours, slashing costs by up to 70% on infrastructure alone. I’ve seen teams transform from bogged-down prototypes to live chains in weeks, not quarters.

That table underscores why abstract rollup technology stands out. Providers vary, but platforms prioritizing open standards dodge the vendor lock-in traps plaguing others. Centralization worries? Distributed sequencers and community governance options keep control in your hands. No single point of failure means your app-chain thrives, even if ETH dips another 0.68% in 24 hours.

Navigating Rollup Development Challenges with Proven Tooling

Modular rollup tooling sounds sleek, but in practice, it’s a maze of integrations. GitHub repos overflow with half-baked stacks, per Viktor Bezdek’s curated list. Startups grapple with prover optimizations and DA layer choices, only to hit rollup infrastructure bottlenecks at scale. RaaS flips this: pre-vetted components handle the heavy lifting, letting you tweak for DeFi yields or gaming TPS without starting over.

Take liquidity fragmentation, Gate. com’s Layer 2 bugbear. Shared sequencers in top RaaS setups bridge silos, mimicking OP Stack wins but with cross-chain pizazz. Alchemy pushes custom Ethereum rollups for blockspace control; we amplify that affordability across ecosystems. For blockchain startup rollups, this means users stick around, boosting retention over fragmented hops.

Top 5 Reasons to Switch to RaaS

-

1. Lightning-Fast DeploymentRaaS platforms like Alchemy and Instanodes enable startups to launch custom rollups in days, not months, via low-code tools and one-click setups.

-

2. Reduced Complexity & Expertise NeedsProviders handle sequencers, verifiers, and infrastructure, demystifying rollup deployment so teams focus on building apps, not ops.

-

3. Cost-Effective ScalabilityAvoid hefty upfront costs with pay-as-you-go models, making high-performance custom blockspace affordable for resource-strapped startups.

-

4. Seamless L1 IntegrationsEasy compatibility with Ethereum, Polygon, and Binance Smart Chain ensures secure, timely state sync and settlements.

-

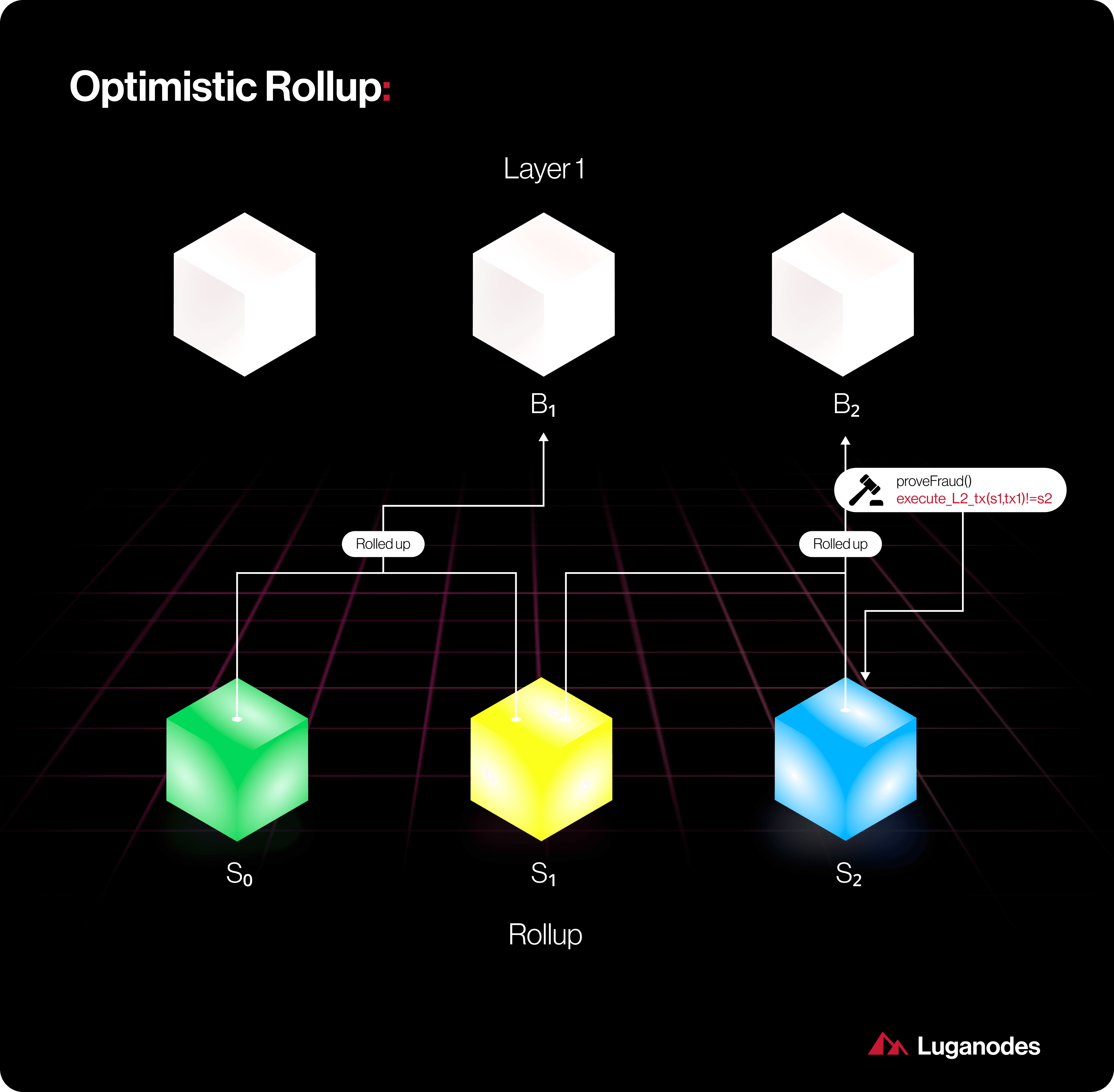

5. Solves Key BottlenecksOvercome state sync crises and fragmentation with managed zk-Rollups and Optimistic Rollups for reliable, scalable app-chains.

Our platform at abstractwatch. com embodies this edge. Expert support isn’t lip service; it’s on-demand troubleshooting for sequencer hiccups or verifier tweaks. Dive into how RaaS accelerates deployments, tailored for your stack. With 99.99% uptime, your chain hums while you build moats.

Future-Proofing Your App-Chain Bets

Looking ahead, Zeeve pegs RaaS as modular infrastructure’s cornerstone by late 2020s. Sovereign rollups’ state sync crisis? Mitigated via hybrid models blending autonomy with shared verification. Startups leveraging this today position for ETH’s next leg up from $2,938.34. QuickNode’s builder playbook echoes it: prioritize performance strategies early.

Yet risks persist. Proprietary tweaks create migration nightmares; always probe exit ramps upfront. Centralization via one provider’s ops? Demand audited, decentralized alternatives. Abstractwatch. com designs around these, offering sovereign-grade flexibility without the solo sync strife ChainScore Labs warns of.

TokyoTechie and peers shine in 2025 lists, but forward thinkers eye 2026 evolutions like low-code rollouts Vocal. media touts. Outlook India’s take rings true: RaaS demystifies deployment, unlocking scalable layers. Your startup’s app-chain deserves this leap.

Builders, the modular era rewards speed and smarts. Sidestep rollup development challenges by partnering with a RaaS leader. Explore simplified app-chain paths and join ecosystems thriving on abstract tech. Ethereum at $2,938.34 signals stability; your rollup can deliver the scalability punch. Stay curious, launch ahead.