In 2026, Solana developers face a pivotal moment: the network’s blistering speed, now underscored by Binance-Peg SOL trading at $85.78 with a 24-hour gain of and $5.98, demands even more tailored scalability for custom applications. Yet, mainnet congestion persists during peak loads. Enter Rollup-As-A-Service (RaaS), particularly platforms leveraging abstract rollup technology, which empowers builders to launch sovereign app-chains without wrestling infrastructure nightmares. This shift isn’t hype; it’s a pragmatic evolution, letting Solana devs deploy high-throughput chains optimized for NFTs, DeFi, or gaming, all while inheriting Solana’s low fees and sub-second finality.

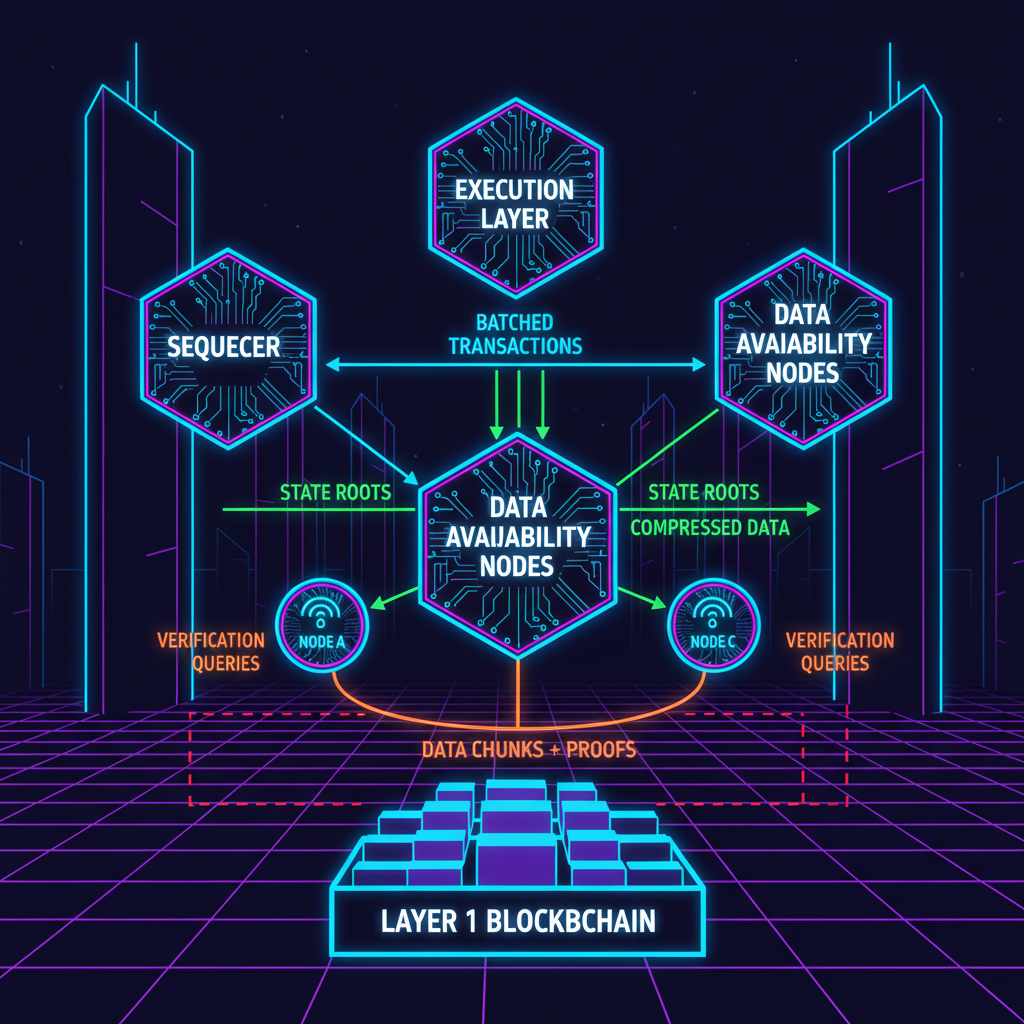

Solana’s ecosystem has ballooned, but generic L1s can’t match app-specific needs. App-chain deployment on Solana via RaaS sidesteps this by bundling transactions off-mainnet, batch-posting proofs back for security. Providers like those at abstractwatch. com abstract away sequencer ops, node management, and bridging, slashing launch times from months to days. For risk-averse enterprises, this means controlled sovereignty with Solana-grade performance, mitigating volatility exposure in a market where SOL hovers at $85.78.

Solana’s Rollup Renaissance: From Congestion to Custom Chains

Historically, Solana prioritized raw TPS over customization, peaking at thousands but faltering under spam. RaaS flips the script with rollup as a service Solana stacks, enabling decoupled execution environments. Developers gain full EVM or SVM compatibility, customizing gas models and state for their dApp. Alchemy’s breakdowns highlight tradeoffs: app-chains offer sovereignty minus rollup compression risks, ideal for 2026’s multichain thesis per Zeeve. Tatum. io echoes this, pitting Optimistic vs. ZK rollups, but for Solana devs, SVM-centric options dominate.

Abstract rollups, core to platforms like Rollup-As-A-Service, generalize this further. They decouple consensus from execution, letting Solana devs mix VMs seamlessly. No more forking OP Stack or wrestling Celestia DA; it’s plug-and-deploy.

2026 Breakthroughs Powering App-Chain Deployment Solana Style

Caldera’s December 2024 pivot integrated the SOON stack, birthing the first multi-VM rollup platform. SVM rollups on Ethereum? Now reality, blending Solana’s 50ms blocks with EVM liquidity. SOON’s alpha mainnet hit 30,000 TPS on testnet, crushing fee spikes that plague L1s. Mirror World’s Sonic SVM lets gaming devs spin up in-game DEXes, while MagicBlock’s ephemeral rollups process bursts trustlessly, ditching web2 crutches.

Solana’s post-quantum roadmaps loom, but RaaS fortifies with modular upgrades, per Medium analyses.

These aren’t silos; chain abstraction unifies UX, per Zeeve. QuickNode ranks top RaaS for UI simplicity, but Solana’s edge lies in native speed. Dysnix executives note RaaS boosts throughput by offloading TXs, posting data back efficiently. Intel’s 2026-2032 outlook pegs RaaS market explosion, driven by such innovations.

Why Abstract RaaS Accelerates Custom Rollups RaaS for Solana Devs

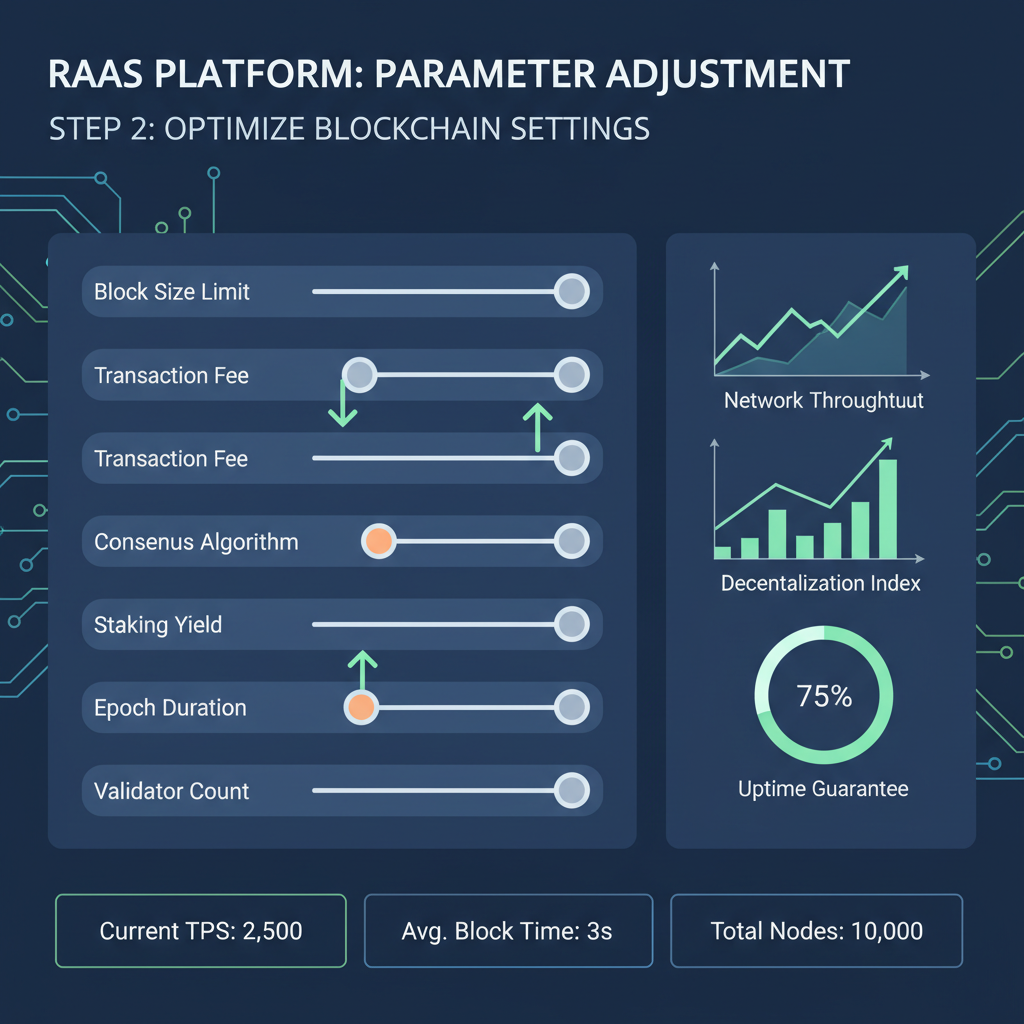

In my eight years dissecting DeFi risks, nothing beats measured scalability. Rollup-As-A-Service by abstractwatch. com exemplifies this: one-click app-chain launches with robust docs and 99.99% uptime. Solana devs configure VMs, DA layers, and provers via intuitive dashboards, focusing on code not ops. Transak dubs it low-code magic, akin to Gelato but Solana-tuned.

Solana (SOL) Price Prediction 2027-2032

Amid Rollup-as-a-Service (RaaS) growth enabling custom app-chain launches for Solana developers

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $75.00 | $130.00 | $220.00 | +51% |

| 2028 | $100.00 | $180.00 | $320.00 | +38% |

| 2029 | $140.00 | $250.00 | $450.00 | +39% |

| 2030 | $200.00 | $350.00 | $650.00 | +40% |

| 2031 | $280.00 | $500.00 | $900.00 | +43% |

| 2032 | $400.00 | $700.00 | $1,200.00 | +40% |

Price Prediction Summary

Solana (SOL) is forecasted to experience robust growth from 2027-2032, driven by RaaS advancements like Caldera, SOON, Sonic SVM, and MagicBlock’s ephemeral rollups. These enable scalable app-chains, boosting developer adoption and performance. Conservative minima account for bear markets and competition, while maxima reflect bull cycles, quantum-resistant upgrades, and market cap expansion toward $500B+. Baseline: $85.78 (Feb 2026).

Key Factors Affecting Solana Price

- RaaS platforms (Caldera Multi-VM, SOON Decoupled SVM) enhancing Solana scalability to 30k+ TPS

- Custom app-chain launches reducing fees and improving UX for dApps/gaming/NFTs

- Market cycles with post-2026 bull recovery and 2028-2029 halving effects

- Regulatory progress and institutional adoption amid chain abstraction trends

- Competition from Ethereum L2s/BNB Chain, post-quantum security roadmaps

- Ecosystem growth via interoperability, reduced fragmentation, and Web3 innovation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Consider a 2026 NFT marketplace: Blockchain App Factory roadmaps demand 20,000 and TPS, mirroring BNB’s ambitions. RaaS delivers, with ephemeral modes for spikes. Risks? Sequencer centralization, but abstract designs distribute via committees. Enterprises mitigate via audited stacks, aligning with my ‘measure twice’ ethos.

| Feature | Solana L1 | RaaS App-Chain |

|---|---|---|

| TPS | ~5,000 avg | 30,000 and |

| Customization | Limited | Full VM sovereignty |

| Deployment Time | Weeks | Days |

Enterprises eyeing Solana blockchain scalability find this table revealing: RaaS app-chains eclipse L1 limits, delivering tailored performance without sacrificing security. With Binance-Peg SOL at $85.78, up $5.98 in 24 hours, the timing favors bold deployments.

Streamlining App-Chain Deployment Solana 2026: A Developer Workflow

Launching via Rollup-As-A-Service boils down to intuitive steps, abstracting complexities that once deterred Solana developers. Start with VM selection: SVM for native speed or hybrid for EVM bridges. Configure data availability on Solana or Celestia, set sequencer committees for decentralization, then deploy with one dashboard click. Platforms handle node orchestration, monitoring, and upgrades, freeing you for core logic. This app-chain deployment Solana 2026 model cuts costs 70-80% versus self-hosting, per Dysnix benchmarks.

Gaming studios, for instance, leverage Mirror World’s Sonic to embed DEXes directly, processing in-game trades at 30,000 TPS without mainnet drag. DeFi protocols customize oracles and leverage engines, sidestepping L1 composability tradeoffs. NFT platforms scale mints ephemerally via MagicBlock, handling hype drops seamlessly.

Risk Management in Custom Rollups RaaS: Enterprise Safeguards

As a financial risk manager, I scrutinize sequencer risks foremost. Centralization exposes chains to downtime or malice, but abstract rollups counter with rotating committees and fault proofs. Post-quantum threats? Modular RaaS stacks swap signatures swiftly, outpacing monolithic L1s. Volatility ties to SOL’s $85.78 peg, yet app-chains insulate via fee subsidies and native stables.

| Risk Factor | Mitigation in RaaS |

|---|---|

| Sequencer Failure | Diversified committees; auto-failover |

| MEV Extraction | Custom auction designs |

| Bridge Exploits | Light-client verification |

Intel’s RaaS outlook to 2032 forecasts explosive growth, propelled by Solana’s momentum. Chain abstraction layers unify wallets across rollups, per Zeeve, smoothing user flows. Tatum advises ZK for finality, but Solana devs favor optimistic SVM for cost-speed balance.

Solana Developers’ Edge: Abstract Rollups in Action

Abstract rollups shine for abstract rollups Solana developers, enabling VM-agnostic chains that plug into Solana’s liquidity. No vendor lock-in; export state anytime. QuickNode praises UI-driven configs, but abstractwatch. com elevates with enterprise SLAs, audited bridges, and 24/7 support. A DeFi startup might deploy a perp DEX app-chain, hitting 20,000 TPS like BNB’s roadmap, all while SOL trades at $85.78.

Real deployments underscore viability. Caldera’s multi-VM stacks power cross-ecosystem dApps, blending Solana throughput with Ethereum tools. SOON’s 50ms blocks suit high-frequency trading bots. Ephemeral rollups handle viral events, auto-dissolving post-peak to save gas. This ecosystem maturity positions Solana for 2026 dominance in custom rollups RaaS.

Builders prioritizing innovation over ops will converge here. Rollup-As-A-Service equips Solana teams with sovereign scalability, turning congestion woes into competitive moats. Measure your stack twice, then launch once: the abstract future awaits.