In 2026, with Ethereum trading at $1,962.18 amid a modest 24-hour gain of and 0.7470%, DeFi projects grapple with congestion on Layer 1 networks while user expectations for instant, low-cost transactions skyrocket. Enter rollup as a service DeFi solutions like Rollup-As-A-Service from abstractwatch. com, which democratize custom app-chain deployment. These platforms strip away the infrastructure headaches, letting teams spin up tailored rollups that process thousands of transactions per second without compromising security or decentralization.

This shift matters because traditional DeFi protocols, squeezed by high gas fees and latency, risk losing ground to rivals on faster chains. RaaS flips the script, enabling projects to launch sovereign app-chains optimized for lending, derivatives, or perpetuals. No more wrestling with node management or sequencer uptime; instead, focus sharpens on protocol mechanics and liquidity bootstrapping.

Why DeFi Demands Sovereign App-Chains Now

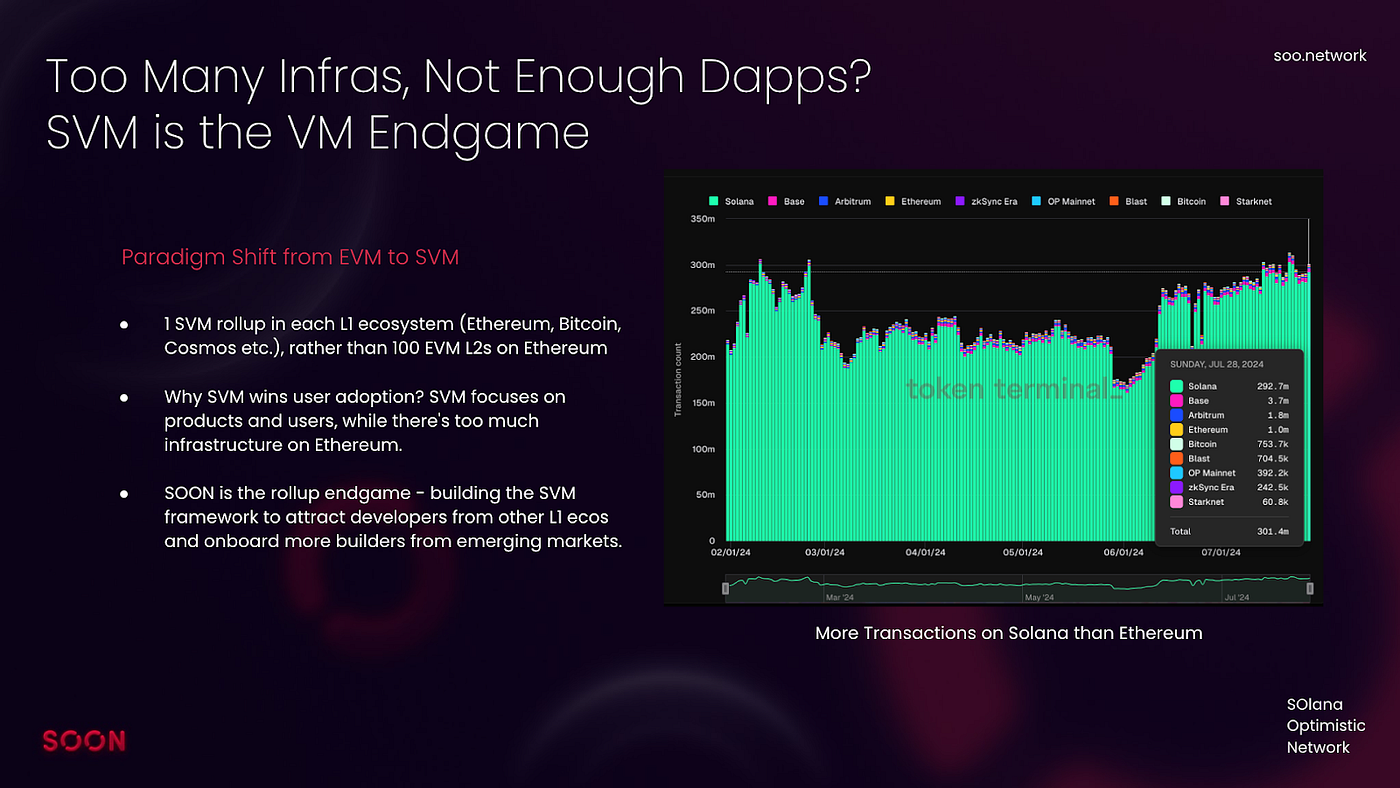

DeFi’s evolution demands more than shared Layer 2s. General-purpose rollups dilute performance for niche applications, fragmenting liquidity across ecosystems. Custom app-chains, powered by abstract rollups DeFi tech, allow protocols to embed native governance, custom gas tokens, and even integrated oracles directly into the chain. Consider a perpetuals exchange: it can tune state execution for sub-millisecond order matching, sidestepping Ethereum’s bottlenecks even as ETH holds steady at $1,962.18.

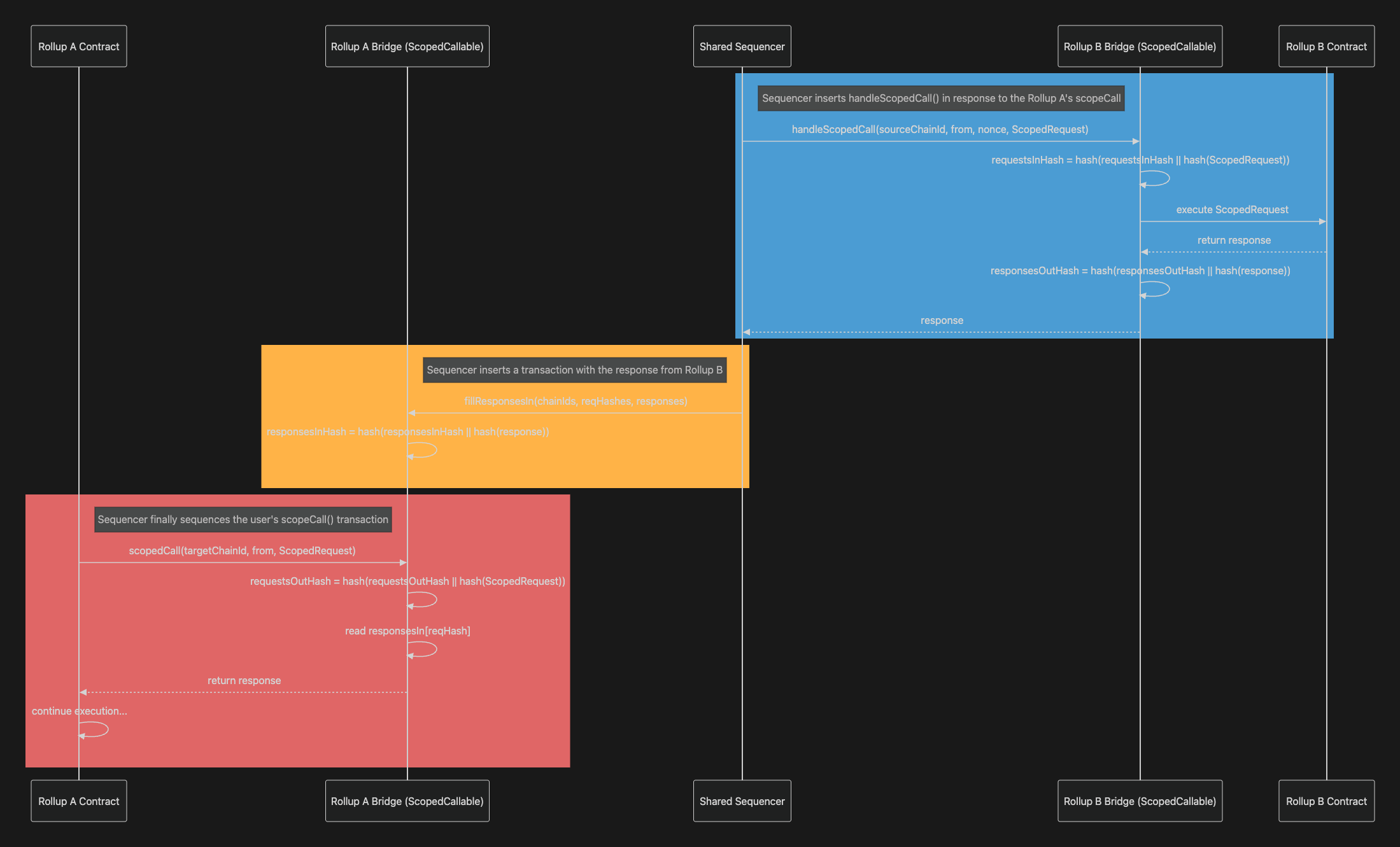

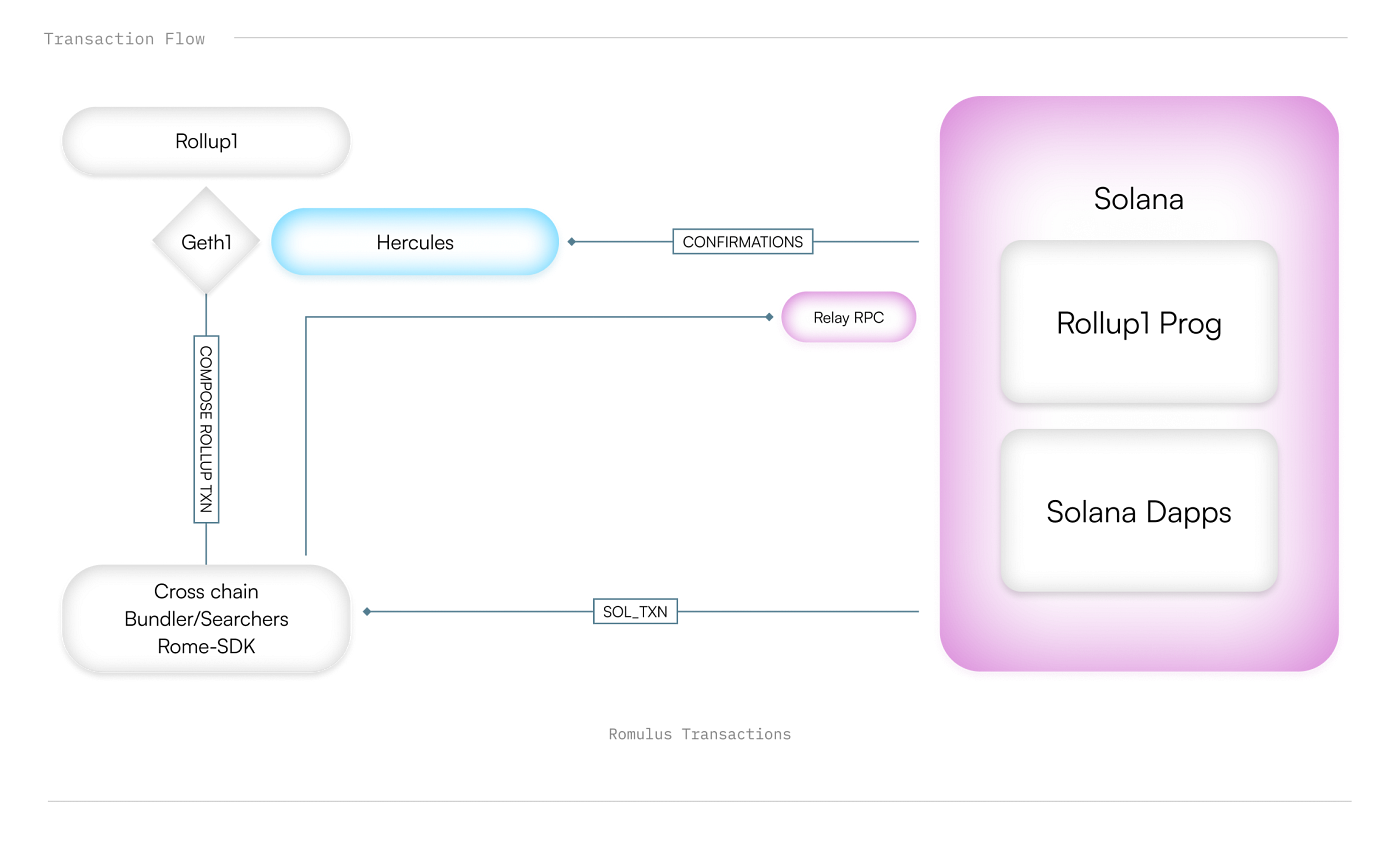

Market dynamics reinforce this. Cross-rollup liquidity protocols, maturing rapidly, bridge isolated chains via shared sequencers and atomic swaps. Yet without RaaS, deployment timelines stretch to quarters, burning capital. Platforms abstract these complexities, slashing setup from months to days. Dysnix and Alchemy highlight how RaaS boosts throughput by offloading TXs, posting compressed data back to Ethereum for finality.

Core Advantages of Rollup-As-A-Service for Deployment

RaaS excels in three disciplines: speed, security, and sovereignty. First, speed. Tools from providers like Caldera or Gelato offer one-click deployments with pre-audited stacks, integrating OP Stack or Arbitrum Orbit. Abstractwatch. com’s service stands out for its rollup-as-a-service 2026 focus, delivering 99.99% uptime and seamless Ethereum settlement.

Security follows suit. RaaS platforms enforce battle-tested fraud proofs and validity schemes, mitigating risks that plague self-built chains. Zeeve notes RaaS versus SDKs: the former handles ops, letting devs prioritize code. For DeFi, this means permissionless launches with inherited Ethereum liquidity, crucial as ETH’s 24-hour high of $2,001.87 tests resistance.

Sovereignty seals the deal. Customize VM environments, EVM compatibility, or even zk-proofs for privacy-focused yield farms. Conduit. xyz emphasizes simplified management, freeing teams for innovation over ops drudgery.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts incorporating Rollup-as-a-Service (RaaS) adoption, custom app-chain launches for DeFi, and enhanced Ethereum scalability

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $2,100 | $3,800 | $6,200 |

| 2028 | $2,800 | $5,500 | $9,000 |

| 2029 | $3,500 | $8,000 | $13,500 |

| 2030 | $4,500 | $11,500 | $18,000 |

| 2031 | $6,000 | $15,000 | $24,000 |

| 2032 | $7,500 | $20,000 | $32,000 |

Price Prediction Summary

Ethereum’s price is projected to experience strong growth from 2027-2032, with average prices climbing from $3,800 to $20,000, fueled by RaaS-driven rollup proliferation, DeFi app-chain customization, and improved cross-chain liquidity. Bullish scenarios reflect peak adoption and market cycles, while minimums account for potential regulatory hurdles or corrections.

Key Factors Affecting Ethereum Price

- Widespread RaaS adoption (e.g., Caldera, Conduit, AltLayer) enabling easy custom rollups for DeFi projects

- Scalability boosts reducing fees and increasing throughput on Ethereum L2s

- Cross-rollup liquidity protocols mitigating fragmentation

- Favorable market cycles post-2026 with institutional inflows

- Regulatory clarity on L2s and DeFi enhancing confidence

- ETH’s dominant L2 ecosystem vs. L1 competition

- Ongoing Ethereum upgrades (e.g., future scaling layers) supporting higher valuations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tailoring Scalable DeFi Rollups to Project Needs

Scalable DeFi rollups thrive on customization. RaaS lets projects dial in throughput: optimistic rollups for cost efficiency, zk for trustless speed. A lending protocol might opt for app-specific sequencing, batching borrows/repays to near-zero fees. Governance? On-chain from day one, with token-weighted voting baked in.

Interoperability looms large too. Leading RaaS stacks support IBC-like bridges and chain abstraction layers, unifying user experience across app-chains. Promoteproject. com flags Caldera, Conduit, and AltLayer as frontrunners, but abstractwatch. com edges ahead with developer-friendly docs and support for hybrid rollups. This ecosystem maturity addresses 2025’s fragmentation, positioning DeFi for explosive growth.

Execution demands discipline: pick RaaS for its proven stack, anticipate liquidity flows, and diversify across settlement layers. As Ethereum stabilizes post its 24-hour low of $1,907.15, DeFi builders who leverage RaaS will capture the next wave.

DeFi teams ignoring this edge risk obsolescence. Abstract rollups DeFi via RaaS aren’t just tools; they’re strategic multipliers, turning infrastructure from liability to asset. Builders who master custom app-chain deployment now dictate terms in a fragmented market.

Streamlining Deployment: A Practical Blueprint

RaaS transforms theory into execution. Forget bespoke node fleets or endless audits. Platforms bundle sequencers, provers, and bridges into deployable stacks, tuned for DeFi’s high-velocity demands. Ethereum’s stability at $1,962.18 underscores the timing: low volatility favors bold launches without market panic.

This blueprint cuts weeks from timelines. Developers configure via dashboards: select optimistic or zk flavor, set gas schedules, integrate frontends. Post-launch, automated monitoring flags anomalies, ensuring scalable DeFi rollups hum without hiccups. Gelato’s hosting mirrors this efficiency, but abstractwatch. com layers in superior docs and support, accelerating iteration.

Proven Wins and Ecosystem Momentum

Early adopters validate the model. Imagine a derivatives platform deploying via Caldera: 10,000 TPS, sub-cent fees, native perp settlement. Liquidity? Cross-chain intents route assets fluidly, per customappchains. com insights. AltLayer’s restaking adds yield on idle capital, compounding returns as ETH eyes its 24-hour high of $2,001.87.

Top RaaS Benefits for DeFi App-Chains

-

Rapid Deployment: Launch custom rollups in days via platforms like Caldera and Gelato, accelerating time-to-market for DeFi projects.

-

Cost Efficiency: Eliminate infrastructure overhead, reducing dev and hosting costs compared to self-building with SDKs.

-

Custom Scalability: Tailor throughput, gas fees, and governance for high-volume DeFi apps, boosting performance.

-

Inherited Security: Settle on Ethereum for robust security without managing full node infra.

-

Interoperability: Cross-rollup liquidity protocols solve fragmentation, enabling seamless DeFi asset transfers.

-

Managed Operations: Providers like Conduit and AltLayer handle monitoring, upgrades, and maintenance.

These wins compound. RaaS providers evolve stacks weekly, incorporating danksharding echoes for data availability. DeFi protocols gain moats: proprietary VMs crush generalized L2s on latency, fostering sticky UX. Discipline here pays: audit integrations rigorously, bootstrap TVL via airdrops tied to chain activity.

Fragmentation fades too. Shared security hubs and intent-based bridging unify silos. A yield optimizer spans chains seamlessly, arbitraging rates without bridges’ drag. As Ethereum climbs from its 24-hour low of $1,907.15, RaaS-fueled app-chains siphon volume, pressuring L1 dominance.

Navigating Risks with RaaS Safeguards

No silver bullet exists. Centralization whispers haunt sequencers; RaaS counters with decentralized alternatives and permissionless fault proofs. Regulatory fog? Sovereign chains embed compliance hooks, like geo-fenced access. abstractwatch. com excels here, prioritizing uptime amid volatility.

Cost models demand scrutiny. While RaaS fees beat full-time ops, scale judiciously. Start testnets, migrate post-audit. Interop remains pivotal: prioritize stacks with AggLayer or Superchain affinity for Ethereum liquidity taps.

For deeper dives on execution, explore this step-by-step deployment guide. Pair it with startup-focused simplification tactics.

Forward thinkers act now. With Ethereum at $1,962.18 signaling maturity, RaaS equips DeFi to scale boldly. Custom app-chains aren’t future hype; they’re today’s edge. Diversify stacks, anticipate bridges, execute launches. The chains thriving in 2026? Those built on RaaS discipline.