As Ethereum holds steady at $2,907.92, up a modest $1.05 in the last 24 hours, the blockchain world sharpens its focus on Real-World Assets (RWAs). Institutions crave custom rollups that tokenize everything from private credit to real estate without compromising security or speed. Enter rollup as a service RaaS for RWA app-chains: platforms slashing deployment from months to minutes, much like Rayls is doing for Brazil’s AmFi Alliance. This isn’t hype; it’s the infrastructure shift enabling $1 billion in tokenized assets by mid-2027.

RaaS flips the script on app-chain builds. Developers sidestep the grind of sequencing, bridging, and settling, plugging into proven stacks instead. Rayls exemplifies this: fresh off a Halborn audit, it’s locking in institutional trust while AmFi pours trading volume into its ecosystem, backed by 5 million RLS tokens. For projects eyeing custom rollups institutional DeFi, Rayls sets the bar, but RaaS providers make replication straightforward.

RaaS Providers Dominating RWA Deployments in 2026

Alchemy Rollups leads with seamless integration, powering dedicated chains that hum without ops headaches. Conduit backs heavyweights like Codex and Plume, delivering production-grade uptime. Caldera customizes for high-throughput needs, fueling Manta Pacific and Treasure. Gelato bundles oracles, bridges, and indexers, ideal for RaaS app chains hungry for peripherals.

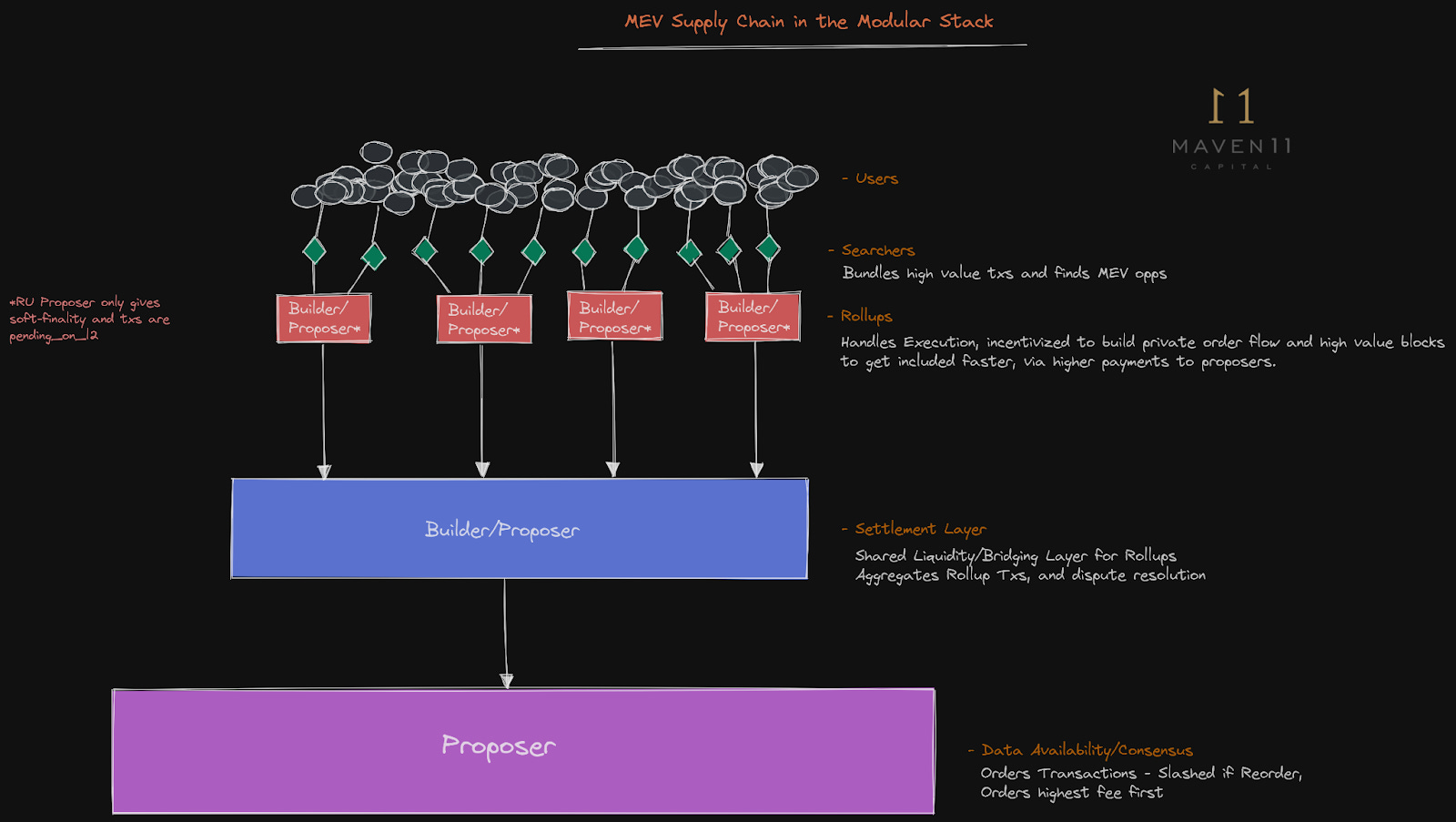

The market backs this surge: RaaS ballooned from $1.12 billion between 2024-2025 at over 29% CAGR. It’s industrialization at work, swapping bespoke engineering for plug-and-play rollups. Yet, pick wisely; vendor lock-in looms large. Proprietary tweaks pile on technical debt, and sequencer downtime could freeze your chain while providers skim MEV.

Rayls Blueprint: Deploying Secure Rollups Rayls Style

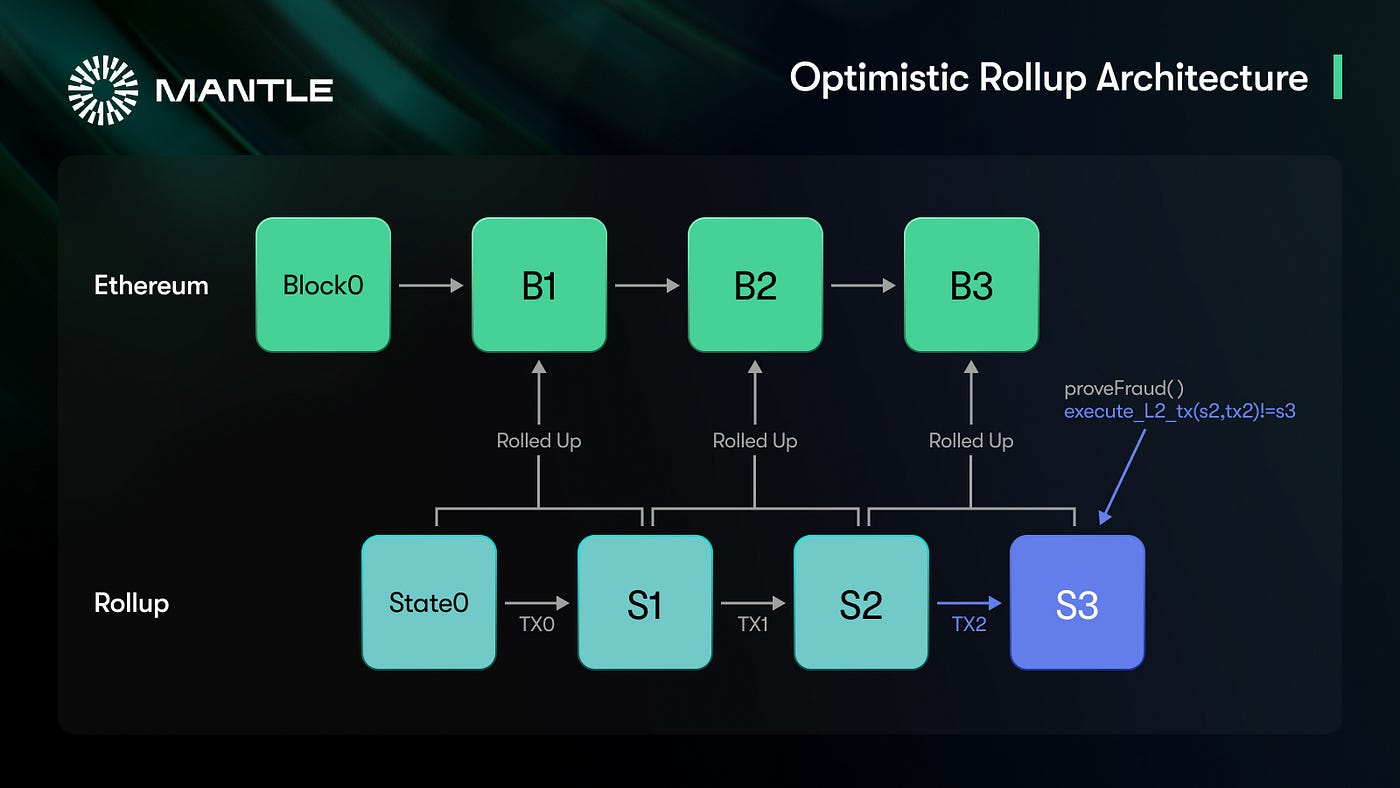

Rayls nails deploy rollups Rayls style by prioritizing audits first, then partnerships. Halborn’s stamp greenlights bank-grade deploys, while AmFi’s billion-dollar push via private credit tokenization proves RWAs scale. Their stack leverages Ethereum’s L1 security, batching transactions for cheap, fast execution. Developers mirror this via RaaS: select zk or optimistic flavors, tune gas limits, integrate data availability layers.

Consider the flow. Start with a node provider for execution, layer on a sequencer for ordering, settle to Ethereum at $2,907.92. Risks? Misaligned incentives if your RaaS captures fees unfairly. Solution: opt for open stacks minimizing proprietary bits, easing future migrations without re-audits.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts Amid Rollup-as-a-Service (RaaS) Growth and Real-World Asset (RWA) App-Chains Adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,900 | $4,800 | $7,500 | +65% |

| 2028 | $3,800 | $7,200 | $11,500 | +50% |

| 2029 | $5,000 | $10,800 | $17,000 | +50% |

| 2030 | $6,500 | $16,200 | $25,500 | +50% |

| 2031 | $8,500 | $22,000 | $33,000 | +36% |

| 2032 | $11,000 | $30,000 | $42,000 | +36% |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience strong growth from 2027 to 2032, driven by RaaS platforms enabling scalable, secure rollups for RWA app-chains. Average prices are projected to rise from $4,800 in 2027 to $30,000 by 2032 (over 6x from 2026’s $2,908 baseline), reflecting bullish adoption trends tempered by bearish risks like market cycles and vendor dependencies. Min/max ranges account for volatility.

Key Factors Affecting Ethereum Price

- Proliferation of leading RaaS providers (Alchemy Rollups, Conduit, Caldera, Gelato) simplifying custom rollup deployments

- RWA tokenization surge, e.g., AmFi Alliance’s $1B asset commitment on Rayls by 2027

- Ethereum L2 scalability enhancements via rollups boosting throughput and reducing costs

- RaaS market expansion at >29% CAGR, shifting to industrialized blockchain infrastructure

- Institutional trust from security audits (e.g., Rayls by Halborn) and production-grade reliability

- Regulatory progress on tokenized assets and potential ETF expansions

- Risks: vendor lock-in, sequencer failures, MEV capture, and crypto market cycles influencing price ranges

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Risks in Custom Rollup Builds

Dependency bites back. A rogue sequencer halts your abstract rollups RWAs 2026, or vendor downtime echoes across your app-chain. MEV capture erodes sovereignty, and stack opacity breeds migration pain. Forward-thinkers audit providers’ uptime religiously, favor modular components, and bake in exit strategies. Rayls dodges this via transparent ops and ecosystem grants, a model worth emulating.

For RWA pioneers, RaaS isn’t optional; it’s the accelerator. Pair it with Ethereum’s resilience at current levels, and you’re building for trillions in tokenized value. Providers like those above, plus emerging rollup as a service RWA specialists, equip you to launch secure, sovereign chains that institutions can’t ignore.

Check out how RaaS revolutionizes scalability for deeper dives into these dynamics.

Teams deploying rollup as a service RWA stacks prioritize modularity to sidestep lock-in traps. Open-source sequencers, portable data availability, and standardized bridges let you swap providers mid-flight without chain rewrites. Rayls threads this needle, exposing its stack for audits and forks, a blueprint for sovereignty in RaaS app chains.

Actionable Steps to Launch Rayls-Style RWA Rollups

Skip theory; execute. Pick a provider like Caldera for throughput or Alchemy for ops ease. Configure your VM: EVM-compatible for DeFi tools, or tweak for RWA-specific logic like compliance oracles. Integrate Halborn-level audits pre-launch. Batch private credit txs at sub-cent fees, settling to Ethereum’s $2,907.92 security. Testnet first, mainnet in days.

Institutional DeFi thrives here. Tokenize $1B assets? AmFi’s playbook scales via RaaS, dodging Ethereum congestion while inheriting its proof-of-stake fortress. Custom gas tokens align incentives, rewarding sequencers fairly without MEV grift.

Top 5 RaaS Advantages for RWA DeFi

-

Minutes-to-deploy speed: Launch custom rollups in minutes vs. months using Eco RaaS or Alchemy Rollups.

-

L1 security inheritance: Inherit Ethereum’s security for institutional RWA rollups like Rayls post-Halborn audit.

-

Modular components avoid lock-in: Use interoperable stacks from Caldera and Conduit to dodge vendor dependencies.

-

Built-in scalability for RWA volume: Support high-throughput RWA like AmFi’s $1B tokenization target by 2027.

-

Cost savings over self-builds: 29% CAGR RaaS market cuts costs vs. custom engineering with Gelato.

Vendor risks demand vigilance. Scrutinize SLAs: 99.99% uptime minimum, force-exit mechanisms for sequencers, and open APIs for data export. Diversify: run shadow nodes off-provider. Rayls mitigates via community governance, distributing control beyond any single entity.

RaaS Evolution for 2026 RWA Dominance

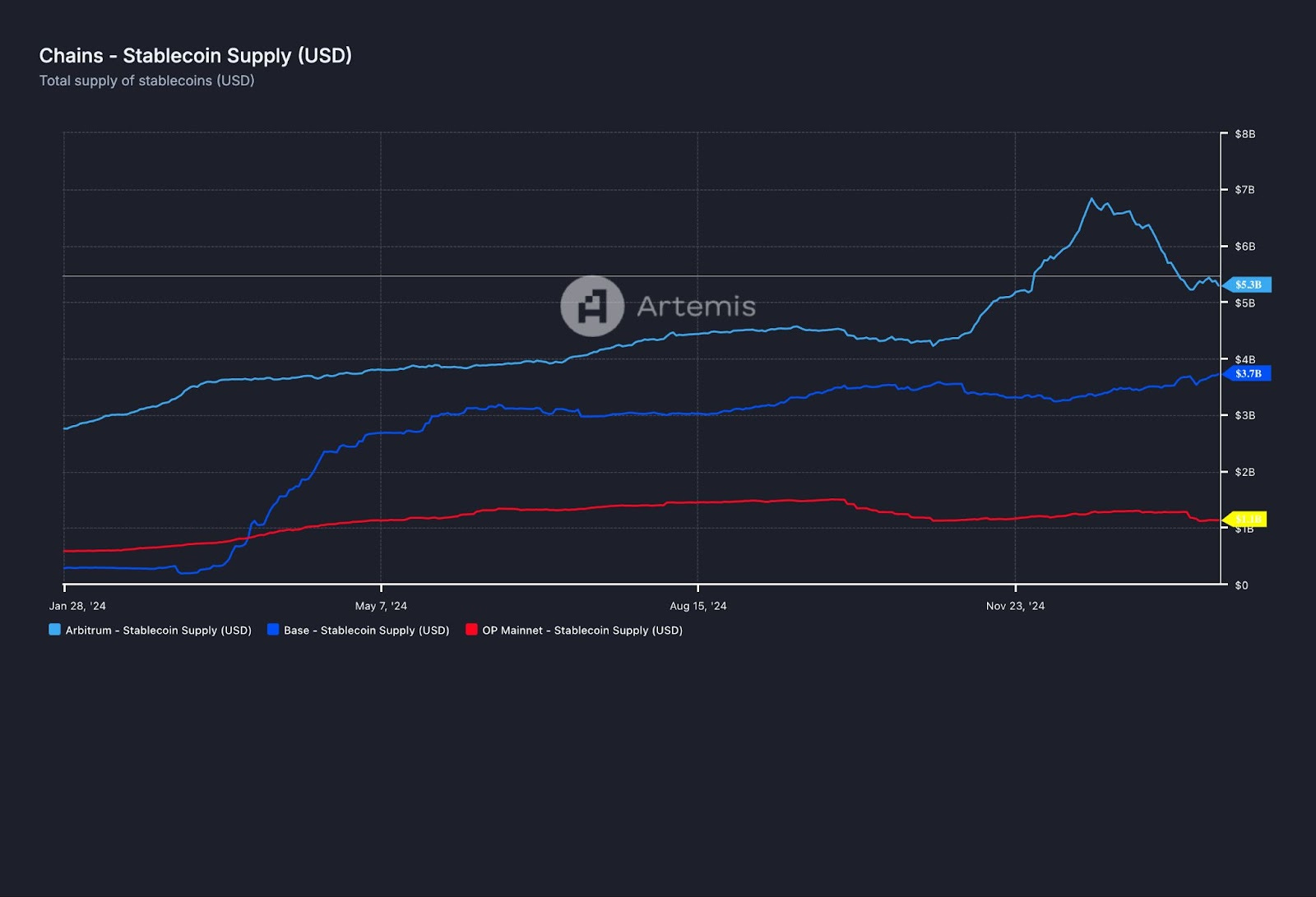

By mid-2026, expect abstract rollups RWAs 2026 to standardize around shared sequencers and elastic DA layers. Providers converge on interoperability, letting your chain hop L1s seamlessly. Ethereum at $2,907.92 anchors this, its L2 ecosystem exploding as RWAs migrate from pilots to production.

Gelato’s peripheral integrations shine for RWAs needing real-time feeds: Chainlink oracles for asset prices, bridges for cross-chain collateral. Conduit’s reliability powers enterprise bets, proving rollups handle bank volumes without hiccups.

Projects ignoring RaaS lag. Self-sovereign chains demand teams of 20 and engineers; RaaS condenses to 2-3 specialists. Rayls-AmFi validates: audits unlock banks, grants bootstrap liquidity. Replicate via this step-by-step launch guide, then layer on simplified appchain tactics.

RWA tokenization hits escape velocity when rollups mature. With Ethereum steady, providers iterating, and audits normalizing, 2026 deploys sovereign chains that tokenize the real economy at scale. Builders: spin up your stack today; the trillions await.