In the bustling world of blockchain development, startups face a familiar bottleneck: scaling without compromising security or decentralization. Enter rollup as a service (RaaS), a game-changer that streamlines app chain deployment for custom rollups. As Ethereum trades at $2,926.05, down 2.42% over the last 24 hours with a high of $3,001.88 and low of $2,908.92, the demand for efficient Layer 2 solutions has never been more pressing. RaaS platforms abstract away the infrastructure headaches, letting innovators focus on what matters: building disruptive applications.

Decoding Rollups and Appchains in Today’s Blockchain Landscape

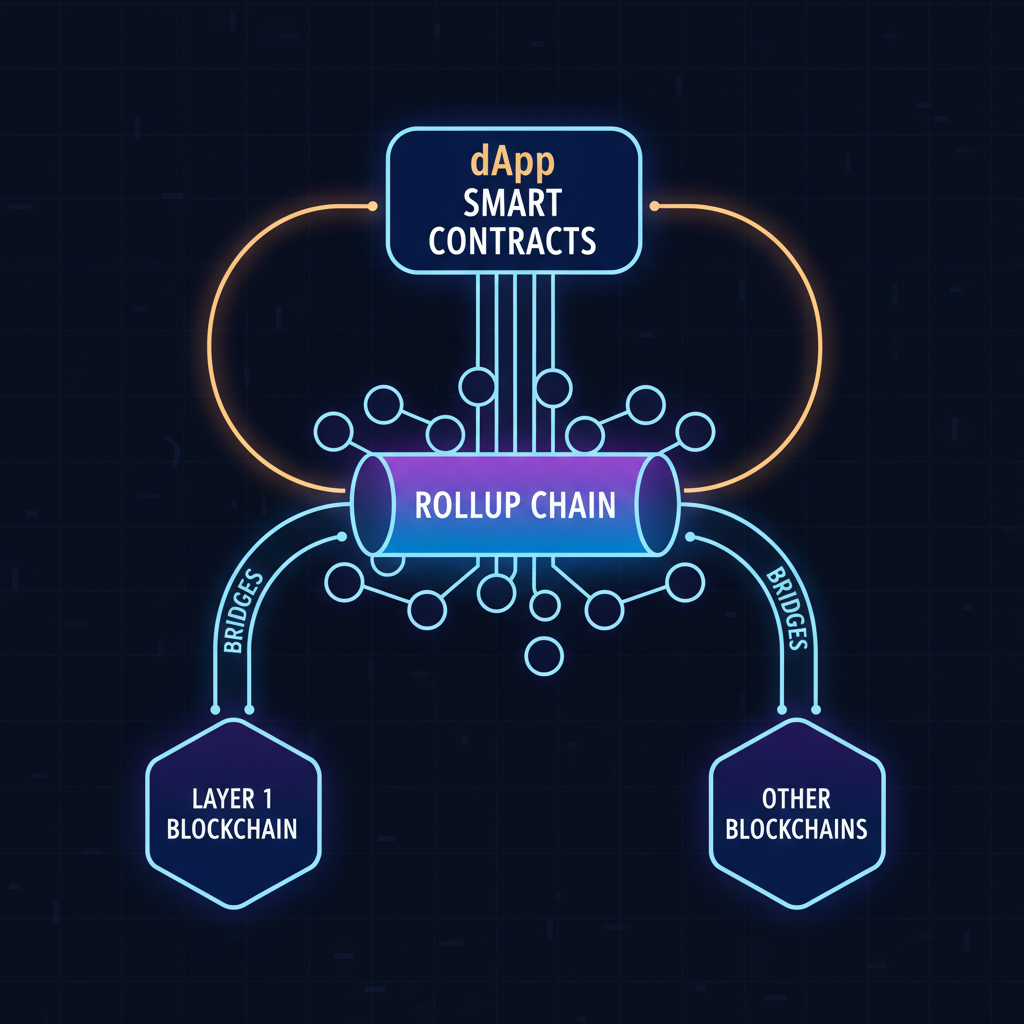

A rollup is essentially a customized blockchain that boosts Ethereum’s scalability by handling computations and data off-chain while settling proofs on the mainnet. Appchains, or application-specific chains, take this further by tailoring the entire stack to a single use case, like DeFi protocols or gaming ecosystems. Traditional deployment meant wrangling complex SDKs, node management, and security audits, often taking months and burning through venture capital.

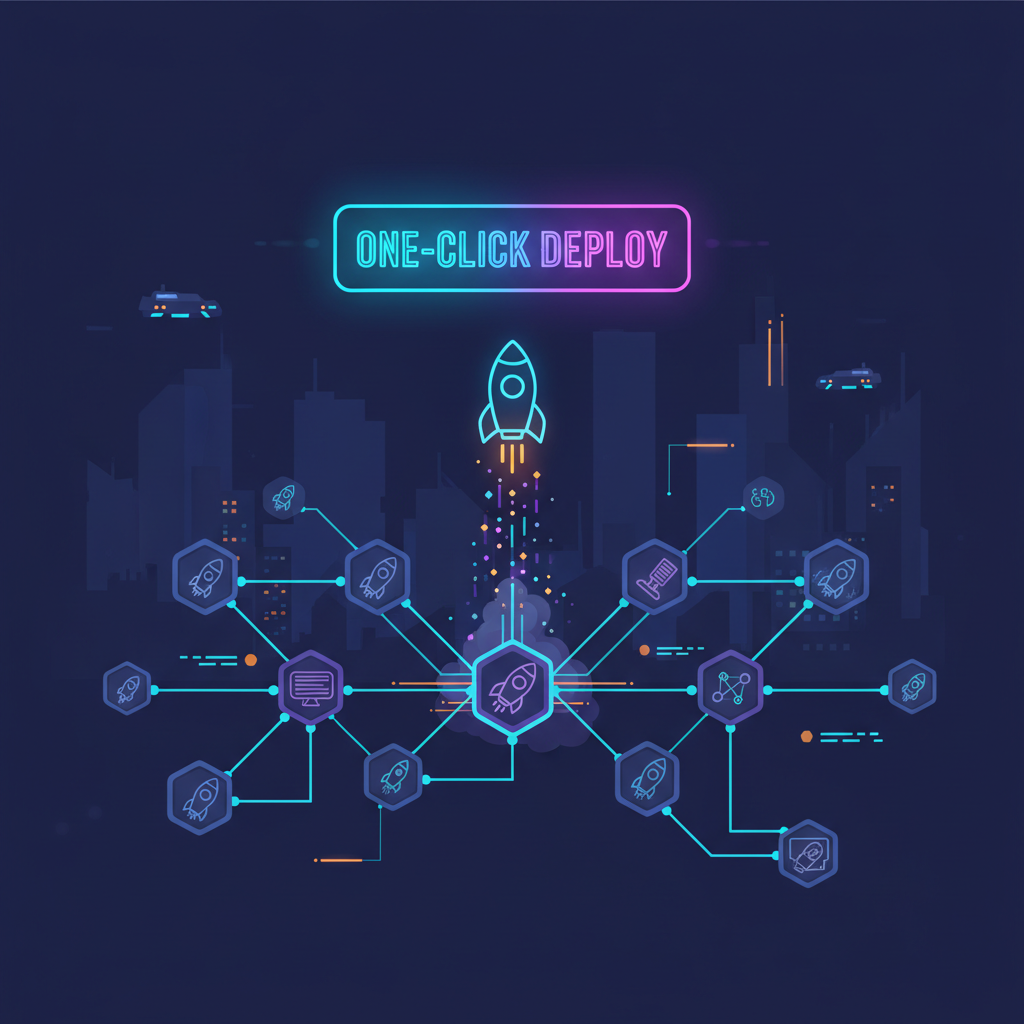

But RaaS flips the script. Providers like those highlighted in recent market analyses offer managed services that deploy optimistic or zero-knowledge rollups with enterprise-grade infrastructure. Think one-click launches, as seen with Gelato’s platform, which integrates account abstraction and standards like ERC-4337. For blockchain startups, this means custom rollups blockchain setups that scale seamlessly, reducing costs and time-to-market dramatically.

This shift aligns perfectly with the current market dynamics. With ETH’s price reflecting ongoing Layer 2 adoption, startups can now leverage abstract rollup technology without deep infrastructure expertise.

Why RaaS is a Must-Have for Blockchain Startups

Imagine launching a sovereign appchain in minutes, not months. That’s the promise of RaaS, as echoed by platforms like Zeeve and BNB Chain’s opBNB. Startups gain access to optimized sequencing, data availability layers, and compliance tools, all while maintaining sovereignty over their chain’s rules. I’ve seen too many promising projects stall on ops drudgery; RaaS liberates them to iterate on core value propositions.

Security stands out as a cornerstone benefit. Off-chain processing with on-chain verification minimizes risks, and managed services include SLAs that rivals can’t match. For RaaS for startups, this translates to faster funding rounds and user acquisition, as low-latency chains attract high-volume dApps. Opinion: In a space where first-mover advantage is fleeting, skimping on scalable infrastructure is a luxury no founder can afford.

Moreover, RaaS supports hybrid models, blending optimistic and zk-rollups based on your app’s needs. Whether you’re building a high-throughput exchange or a privacy-focused NFT marketplace, the flexibility empowers nuanced designs.

Navigating the RaaS Ecosystem: Providers and Trends

The landscape is vibrant, with Gelato enabling testnet deploys in clicks, Zeeve focusing on app-specific rollups, and Ankr offering no-code options. Scroll and others push zk frontiers, while BNB Chain’s RaaS lowers barriers for cost-sensitive projects. QuickNode’s deep dive underscores how RaaS abstracts SDK chaos, making it dev-friendly.

At abstractwatch. com, our Rollup-As-A-Service embodies this evolution, prioritizing seamless app chain deployment with robust docs and support. As ETH holds at $2,926.05 amid volatility, these tools future-proof startups against network congestion.

Ethereum (ETH) Price Prediction 2027-2032

Forecast incorporating Rollup-as-a-Service (RaaS) advancements, scalability improvements, and market cycles from 2026 baseline of $2,926

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | 43.6% |

| 2028 | $3,800 | $5,800 | $9,000 | 38.1% |

| 2029 | $5,000 | $8,000 | $12,000 | 37.9% |

| 2030 | $6,500 | $11,000 | $16,500 | 37.5% |

| 2031 | $9,000 | $15,000 | $22,000 | 36.4% |

| 2032 | $12,000 | $20,000 | $28,000 | 33.3% |

Price Prediction Summary

Ethereum (ETH) is forecasted to see robust growth from 2027 to 2032, driven by RaaS platforms simplifying custom rollups and app-chains for startups, boosting L2 adoption and scalability. Average prices are expected to rise progressively from $4,200 to $20,000, with bullish maxima up to $28,000 amid favorable cycles, while minima reflect potential bearish corrections.

Key Factors Affecting Ethereum Price

- Rapid adoption of RaaS providers like Gelato, Zeeve, Scroll, and Ankr, enabling quick deployment of Optimistic/ZK rollups

- Ethereum scalability enhancements reducing fees and increasing throughput for dApps and startups

- Technological upgrades (e.g., post-Dencun) and app-chain proliferation strengthening network utility

- Institutional inflows via ETFs and regulatory clarity fostering mainstream adoption

- Crypto market cycles influenced by BTC halvings and macroeconomics

- Competition from L1s like Solana balanced by ETH’s DeFi/smart contract dominance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Trends point to deeper integrations, like EIP-7702 for enhanced UX, signaling RaaS’s maturation. Startups eyeing custom rollups should weigh factors like uptime, customization depth, and ecosystem fit when choosing a provider.

Selecting the right RaaS provider boils down to aligning infrastructure with your project’s vision. Uptime guarantees above 99.9%, seamless integrations with tools like The Graph for indexing, and proactive support teams separate the leaders from the pack. As Ethereum navigates its current price of $2,926.05, reflecting a 2.42% dip, the cost savings from RaaS become even more compelling for bootstrapped teams.

Key Considerations for RaaS for Startups: Costs, Customization, and Scalability

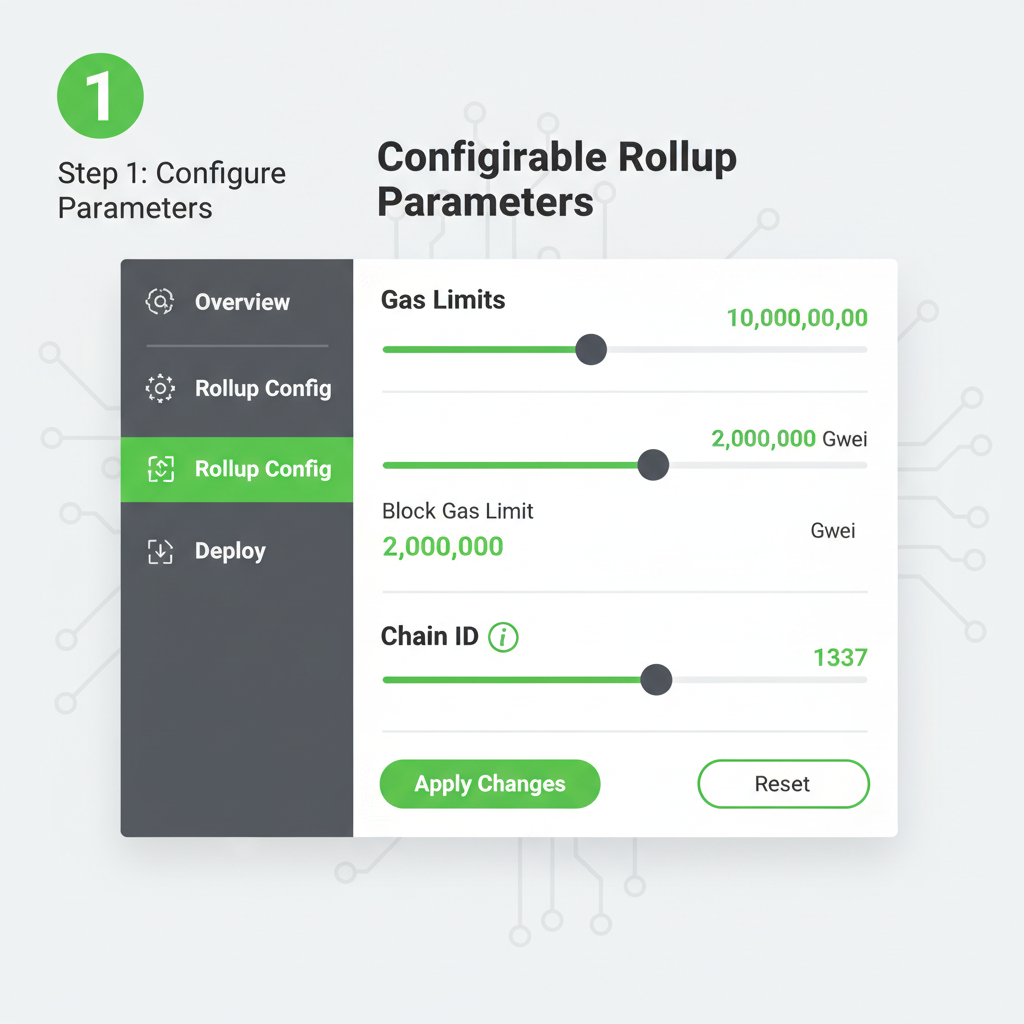

Costs vary, but expect pay-as-you-go models that slash upfront expenses compared to self-hosting. Gelato’s one-click deploys keep things lean, while Zeeve’s enterprise SLAs suit larger ambitions. Customization lets you tweak gas tokens, block times, and even consensus mechanisms, tailoring the chain to your dApp’s rhythm. Scalability shines here: rollups handle thousands of TPS, far outpacing Ethereum’s base layer, without the centralization pitfalls of some alternatives.

In my experience observing blockchain trajectories, startups that prioritize abstract rollup technology gain a defensible moat. You’re not just deploying a chain; you’re crafting a sovereign economy. Yet, pitfalls lurk: over-reliance on a single provider can lock you in, so favor open standards and exportable configs.

Comparison of Top RaaS Providers

| Provider | Deployment Time | Supported Rollup Types | Pricing Model | Key Strengths |

|---|---|---|---|---|

| Gelato | Minutes (1-click) | Optimistic & ZK | Usage-based | 🚀 1-click deployment, Enterprise infra 💼, Account Abstraction ✅ |

| Zeeve | Hours to Days | Optimistic & ZK | Enterprise SLA | 🔒 Security-focused, App-specific rollups 📱 |

| BNB Chain opBNB | Quick (cost-effective) | Optimistic | Cost-effective | 🌐 BNB ecosystem integration, Efficient scaling ⚡ |

| Ankr | No-code (minutes) | Optimistic & ZK | Subscription/Usage | 📊 Comprehensive solutions, No-code deployment 🛠️ |

This table highlights why diversification in evaluation pays off. No one-size-fits-all; a gaming startup might lean toward Gelato’s UX perks, while DeFi builders eye Scroll’s zk proofs for trustless settlement.

Hands-On with RaaS: A Practical Deployment Guide

Ready to launch? The barrier-to-entry has plummeted, turning months-long endeavors into afternoons. Platforms abstract the node orchestration, sequencer setup, and prover networks, handing you a dashboard instead. For more details on the process, check out this step-by-step guide.

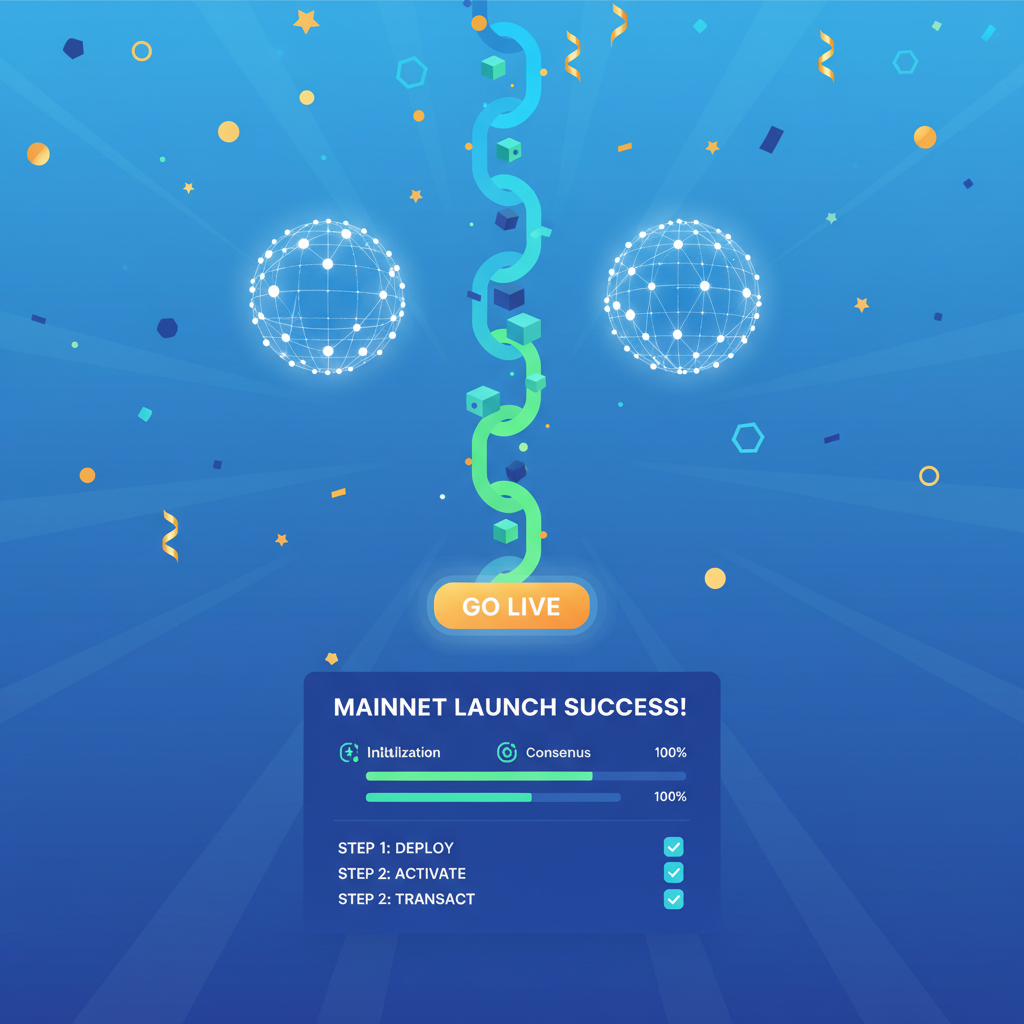

Post-deployment, monitoring tools track metrics like latency and finality, with auto-scaling to handle spikes. I’ve advised teams who went live in under a week, securing seed rounds on the back of proven traction.

Beyond basics, advanced users experiment with shared sequencers or validium hybrids for ultra-low fees. BNB Chain’s opBNB exemplifies cost-efficiency, ideal for high-volume consumer apps. As the ecosystem matures, expect RaaS to incorporate AI-driven optimizations, predicting traffic and preempting bottlenecks.

At abstractwatch. com, our Rollup-As-A-Service distills these best practices into a developer-first experience. Robust documentation walks you through custom rollups blockchain nuances, while our experts offer white-glove onboarding. We’ve powered dozens of appchains, from DeFi vaults to socialFi experiments, each scaling effortlessly as adoption surges.

Challenges remain, of course. Interoperability across rollups demands bridges and standards like Chain Abstraction, but RaaS providers are racing ahead with native support. Regulatory clarity will further catalyze growth, especially for compliance-heavy sectors like tokenized assets.

With Ethereum steady at $2,926.05 despite recent fluctuations, the Layer 2 narrative strengthens. Blockchain startups wielding RaaS aren’t just surviving congestion; they’re thriving in parallel economies. The patient builder, armed with these tools, compounds network effects into enduring value. Dive in, deploy boldly, and let rollup as a service propel your vision forward.