In the fast-paced world of blockchain development, where every millisecond counts, abstract rollup technology is delivering a game-changer: 200ms block times. This leap forward is supercharging rollup as a service 2025 platforms, slashing app chain deployment speed and making custom blockspace a reality for startups overnight. Forget the old days of waiting weeks for confirmations; projects on networks like Base and Optimism are now confirming transactions in the blink of an eye, thanks to innovations like Flashblocks.

Flashblocks Unleash Near-Instant Confirmations

Base, Coinbase’s powerhouse Layer 2, flipped the switch on Flashblocks in July 2025, dropping block times from two seconds to a blistering 200ms. These sub-blocks stream to validators every 0.2 seconds, delivering preconfirmations that feel instantaneous while preserving Ethereum’s ironclad finality. Tested rigorously on Base Sepolia earlier that year, this upgrade with Flashbots has already transformed user experiences in DeFi and gaming.

Optimism isn’t far behind. Their OP Mainnet now runs at 250ms effective block times, with the OP Stack modular framework pushing toward 200ms. This isn’t hype; it’s engineered for high-throughput apps that demand speed without sacrificing security. Union Build’s roadmap echoes this momentum, targeting validator P2P networking upgrades for 200ms blocks alongside Plume-based rollup tooling.

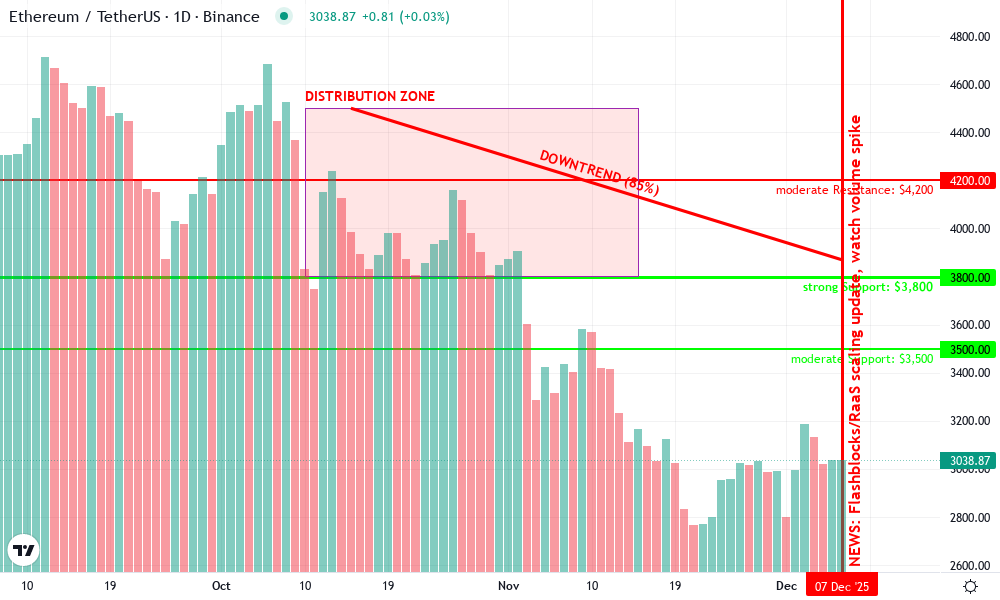

Ethereum Technical Analysis Chart

Analysis by Nora Denning | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

On this ETHUSDT 1D volume chart from Oct to Dec 2025, draw a downtrend line connecting the volume peak at 2025-10-15 (volume ~4500 units, aligning with price high ~$4,500) to the recent low volume at 2025-12-07 (~1000 units, price ~$3,870). Add horizontal lines for key support at $3,800 (recent lows) and resistance at $4,200 (prior consolidation). Use a rectangle for the low-volume consolidation zone from 2025-11-20 to 2025-12-07 between $3,800-$4,000. Mark volume decline with callouts at major bars: high buy volume Oct (green dominant), shifting to sell (red) in Nov. Add arrow down on MACD bearish signal near 2025-11-25. Vertical line at 2025-12-07 for current Flashblocks news context. Text notes for options hedging: ‘Low volume suggests hedging puts.’

Risk Assessment: medium

Analysis: Declining volume tempers scaling bullishness; volatility ripe but no clear direction

Nora Denning’s Recommendation: Enter medium-risk long with options hedge (buy calls, sell strangles for premium)

Key Support & Resistance Levels

📈 Support Levels:

-

$3,800 – Recent volume lows cluster here, strong base for bounce

strong -

$3,500 – Deeper support from Nov troughs

moderate

📉 Resistance Levels:

-

$4,200 – Prior Nov resistance where sell volume spiked

moderate -

$4,500 – Oct volume peak resistance

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$3,850 – Volume consolidation low, bullish scaling news convergence

medium risk

🚪 Exit Zones:

-

$4,200 – Resistance test with volume confirmation

💰 profit target -

$3,700 – Below support invalidates, tight stop

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining overall with red sell dominance in late bars

High Oct volume (green buys) faded to low Dec, bearish divergence from price hold

📈 MACD Analysis:

Signal: bearish crossover mid-Nov

MACD line below signal amid falling volume confirms weakness

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nora Denning is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

RaaS Platforms Ride the 200ms Wave

200ms block times abstract rollups are the secret sauce for RaaS providers dominating 2025. Platforms like Alchemy and Zeeve are buzzing because they solve the infrastructure nightmare: typical custom rollups once demanded 6-9 months, 5-8 engineers, and endless ops costs. Now, with optimized frameworks, deployment shrinks to days. Ankr outlines it simply: sign up, pick your stack, deploy to mainnet or testnet, select data availability, and launch.

This acceleration ties directly into ethereum rollup scalability. EIP-4844’s blobs slashed data costs, but 200ms blocks unlock new primitives like on-chain gaming and socialfi that thrive on low latency. Instanodes and LinkedIn reports highlight top RaaS players offering instant setups across Ethereum, Polygon, and BNB Chain, making app-chains accessible beyond elite teams.

As Ethereum’s rollup ecosystem explodes, the real edge goes to those wielding 200ms speed for responsive dApps.

QuickNode’s deep dive on app-chains underscores RaaS benefits: dedicated blockspace, tailored gas tokens, sovereign control. Calibraint spotlights providers revolutionizing Web3 with these features, but the 200ms factor elevates them from good to essential.

Strategic Wins for Developers and Startups

For blockchain builders, rollup-as-a-service simplifies appchain deployment, but pair it with 200ms blocks and you’ve got a strategic moat. DeFi protocols confirm trades before users blink; games deliver seamless on-chain actions. ChainCatcher’s analysis nails it: rollups scale Ethereum, yet the challenge was usability. Now solved.

DIA Oracles questions if Ethereum scaling is “done” in 2025. My take? Not quite, but 200ms pushes us closer, enabling primitives we couldn’t dream of pre-Flashblocks. Startups gain affordability and custom blockspace without the engineer army, per Alchemy’s guide. Zeeve calls this the hottest rollup framework trend; developers flock for the scalability solve.

Rollup-As-A-Service by abstractwatch. com stands out here, streamlining launches with expert support and uptime that matches these speeds. It’s not just deployment; it’s acceleration toward innovation dominance.

Developers aren’t just deploying faster; they’re iterating at warp speed. With rollup as a service 2025 handling the heavy lifting, teams redirect energy to core logic, crafting dApps that respond like native apps. This shift favors agile startups over lumbering incumbents, turning app chain deployment speed into a competitive weapon.

Deployment Realities: From Months to Minutes

Picture this: a DeFi team sketching a yield optimizer on Monday, deploying to a custom rollup by Friday. That’s the 2025 reality powered by 200ms blocks. Traditional paths burned 6-9 months and hordes of engineers on node ops, sequencing, and DA layers. RaaS flips the script, automating it all via stacks like OP or Plume.

Instanodes crunches the numbers: recurring costs plummet, reliability soars. Ankr’s four-step flow, account, framework, network, data, democratizes this for indie devs. Link it to Base’s Flashblocks, and your app-chain hums at 200ms, outpacing even premium L1s. Union Build’s P2P upgrades ensure validators keep pace, no bottlenecks.

Traditional vs. RaaS 2025: Rollup Deployment Comparison with 200ms Block Times Impact

| Deployment Aspect | Traditional Rollups | RaaS 2025 (200ms Blocks) |

|---|---|---|

| Deployment Time | 6-9 months | Days ⏱️ |

| Engineering Resources | 5-8 engineers | 1-2 developers 👨💻 |

| Operational Costs | High (recurring expenses) | Low 📉 |

| Block Time | ~2 seconds | 200 ms ⚡ |

| Transaction Latency | 1-5 seconds | Sub-200 ms (near-instant preconfirmations) |

| TPS Capacity | 100-2,000 TPS | 10,000+ TPS (optimized for DeFi/gaming) 🚀 |

| Examples | Custom builds | Base (Flashblocks), Optimism OP Stack, Union.Build |

QuickNode breaks down app-chains’ edge: sovereign gas, vertical integration. Add 200ms block times abstract tech, and latency drops unlock socialFi feeds refreshing live or NFT mints without stutter. Calibraint ranks RaaS leaders by uptime and framework support; those embracing speed top the list.

Case Studies Lighting the Path

Base’s ecosystem exploded post-Flashblocks. Gaming titles like on-chain battle royales hit 10,000 TPS peaks, preconfirmations sealing wins before lag kills the vibe. Optimism’s 250ms OP Mainnet powers social apps where posts confirm mid-scroll. Zeeve dubs OP Stack 2025’s hottest framework for good reason: modular, speedy, battle-tested.

Alchemy’s guide spotlights teams snagging custom blockspace affordably. A startup might deploy custom appchains for niche tokens, sidestepping Ethereum congestion. ChainCatcher’s take? Rollups scaled throughput; now speed scales adoption. DIA ponders if scaling’s “done”: I’d argue 200ms marks the inflection to mainstream.

Speed isn’t luxury; it’s the baseline for Web3 to eat mobile’s lunch.

Plume integrations via Union Build add programmable privacy, perfect for enterprise rollups. Developers mix/match: Ethereum DA for security, Polygon for cheap sorts. This composability, turbocharged by sub-second blocks, births hybrids we haven’t named yet.

Future-Proofing with Abstract Rollups

Looking ahead, ethereum rollup scalability hinges on sustaining 200ms across chains. OP Stack’s trajectory promises it; RaaS providers must follow. Abstractwatch. com’s Rollup-As-A-Service leads by bundling these advances: seamless Flashblocks compatibility, one-click Plume deploys, 99.99% uptime. No more infra roulette.

Startups eyeing custom app-chain launches get expert guidance, slashing risks. Gaming studios build lag-free worlds; DeFi labs test strategies live. The moat? Pioneers claiming speed now own tomorrow’s primitives.

Builders, the window’s open. Leverage abstract rollup technology via RaaS to deploy app-chains that don’t just scale, they thrill. Join the acceleration; your next big idea deserves block times this fast.