In 2025, Rollup-as-a-Service (RaaS) platforms have exploded onto the blockchain scene, promising developers a fast track to launching custom app-chains with minimal friction. Yet beneath the hype lies a stubborn reality: bootstrapping liquidity, users, and developers for these new chains remains a brutal uphill battle. As Ethereum scales through rollups, rollup as a service liquidity fragmentation scatters capital across silos, starving fresh app-chains of the network effects they desperately need to thrive.

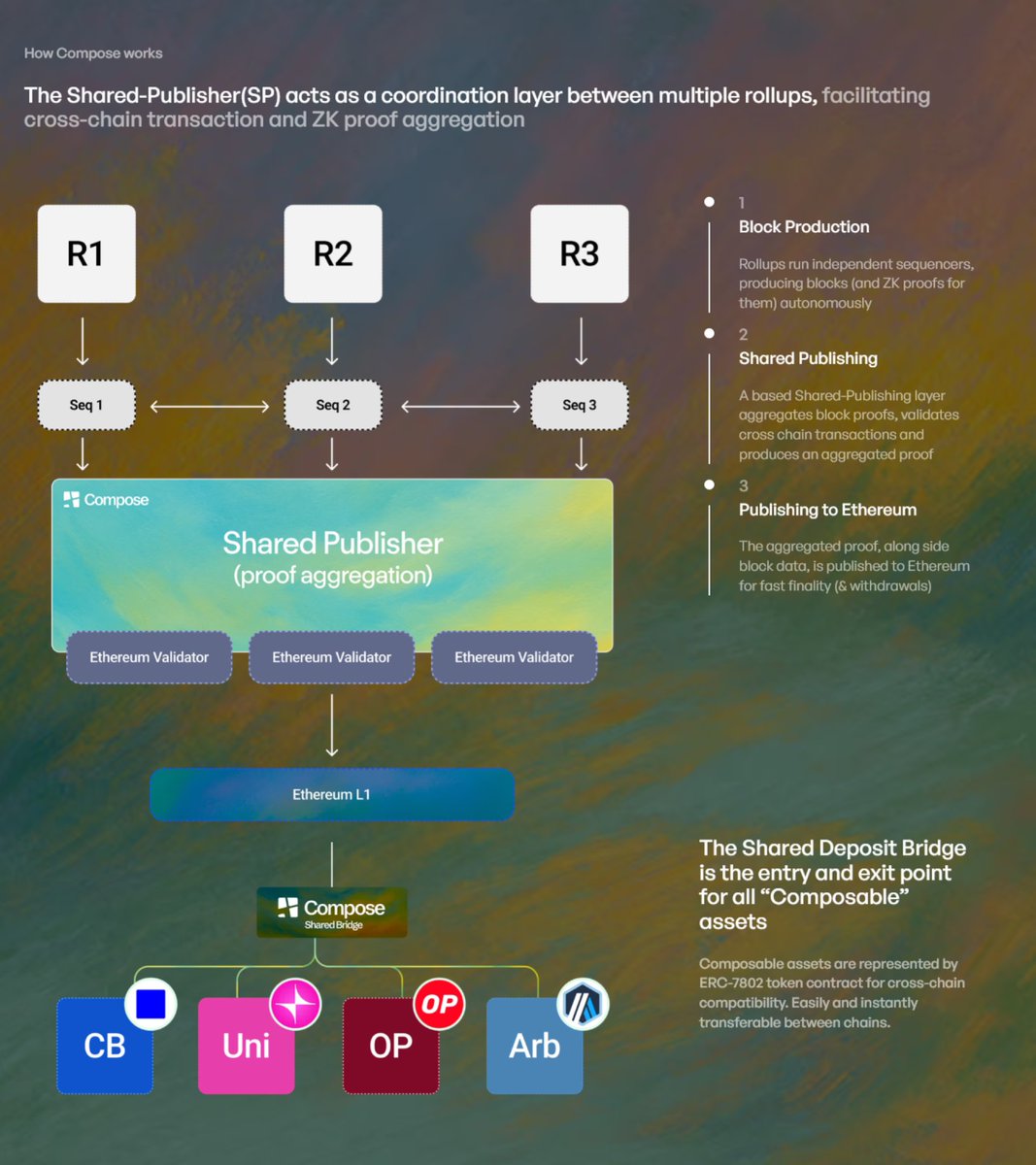

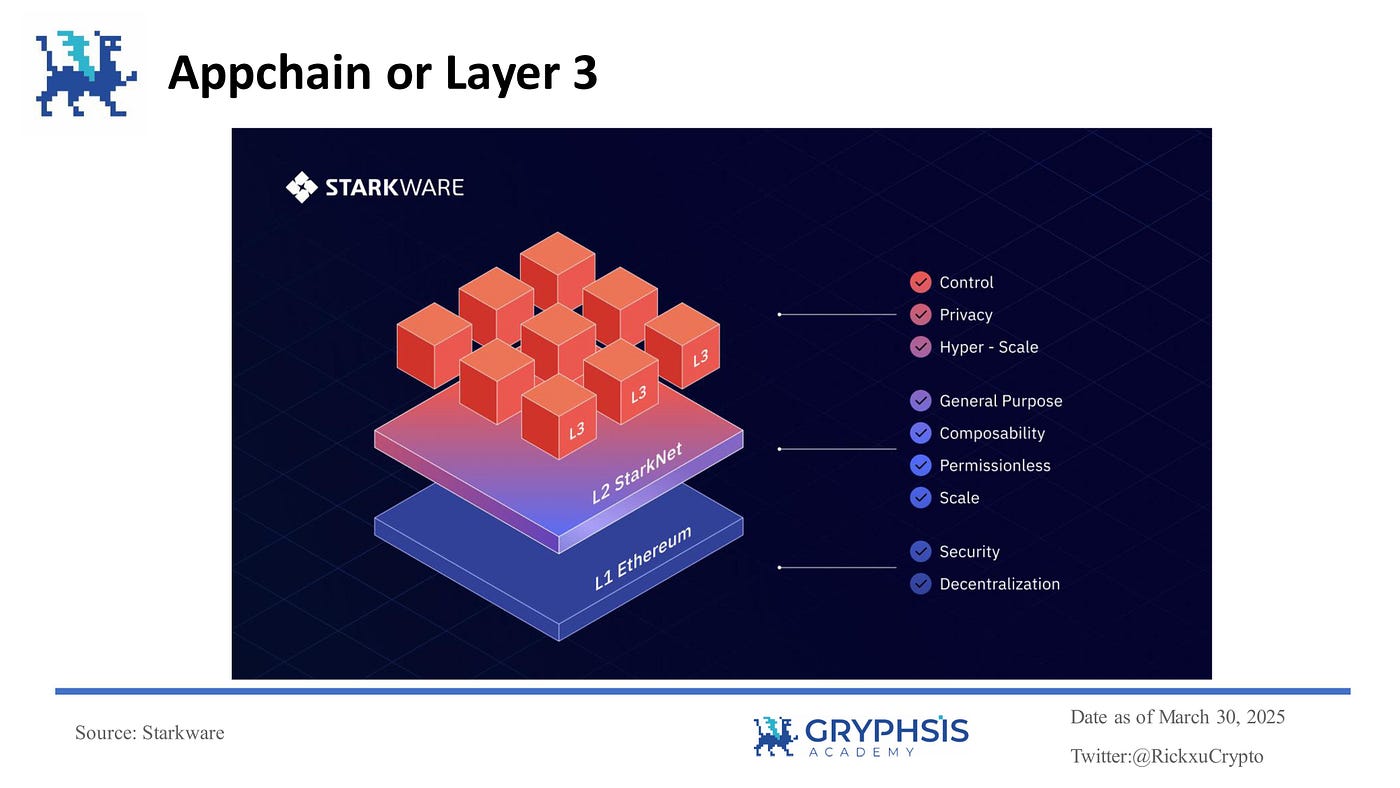

RaaS providers like those highlighted in recent analyses from Alchemy and QuickNode simplify deploying optimistic or ZK rollups, offloading computation from Ethereum while retaining its security. App-chains, essentially sovereign L2s or L3s tailored for specific dApps, should theoretically unlock hyper-specialized scalability. But without deep liquidity, these chains languish as ghost towns, their sequencers humming idly amid empty order books.

Liquidity Fragmentation: The Silent Killer of App-Chain Viability

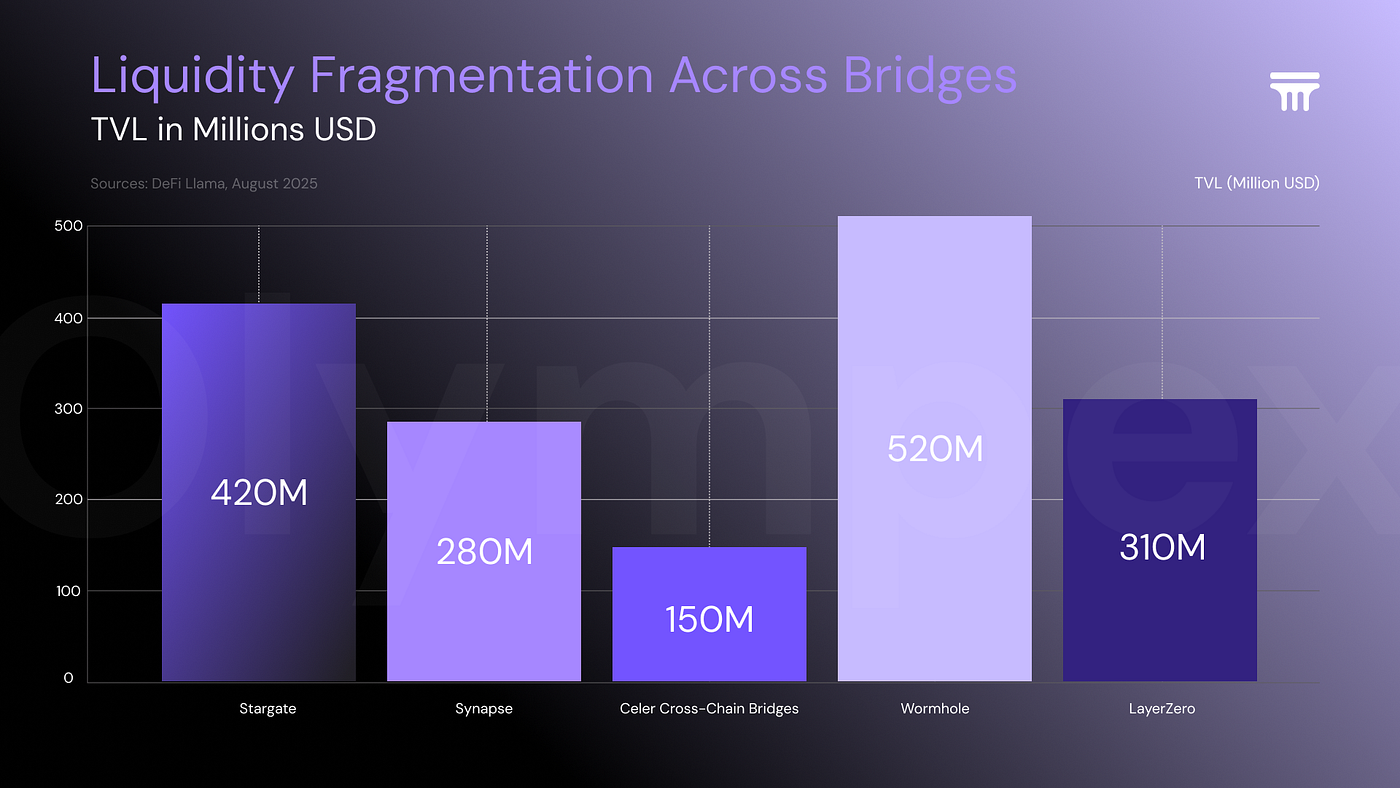

The proliferation of rollups has splintered liquidity like shattered glass. Assets once concentrated on Ethereum now splinter across hundreds of chains, each with its own DEXes and pools. A recent arXiv study nails it: tokens airdropped or bridged to multiple rollups hit minimum liquidity thresholds nowhere, spiking slippage and choking DeFi activity. Trading volumes plummet, lending markets dry up, and users stick to proven hubs like Arbitrum or Base.

This isn’t abstract; it’s a supply-demand crunch in disguise. New app-chains demand immediate depth to attract traders, but fragmented capital means providers must seed pools themselves or beg VCs for grants. App chain bootstrapping turns into a game of musical chairs, where only the well-connected survive. Platforms like Zeeve and thirdweb tout one-click deployments, yet they can’t conjure users from thin air.

Interoperability Roadblocks: Islands in a Sea of Potential

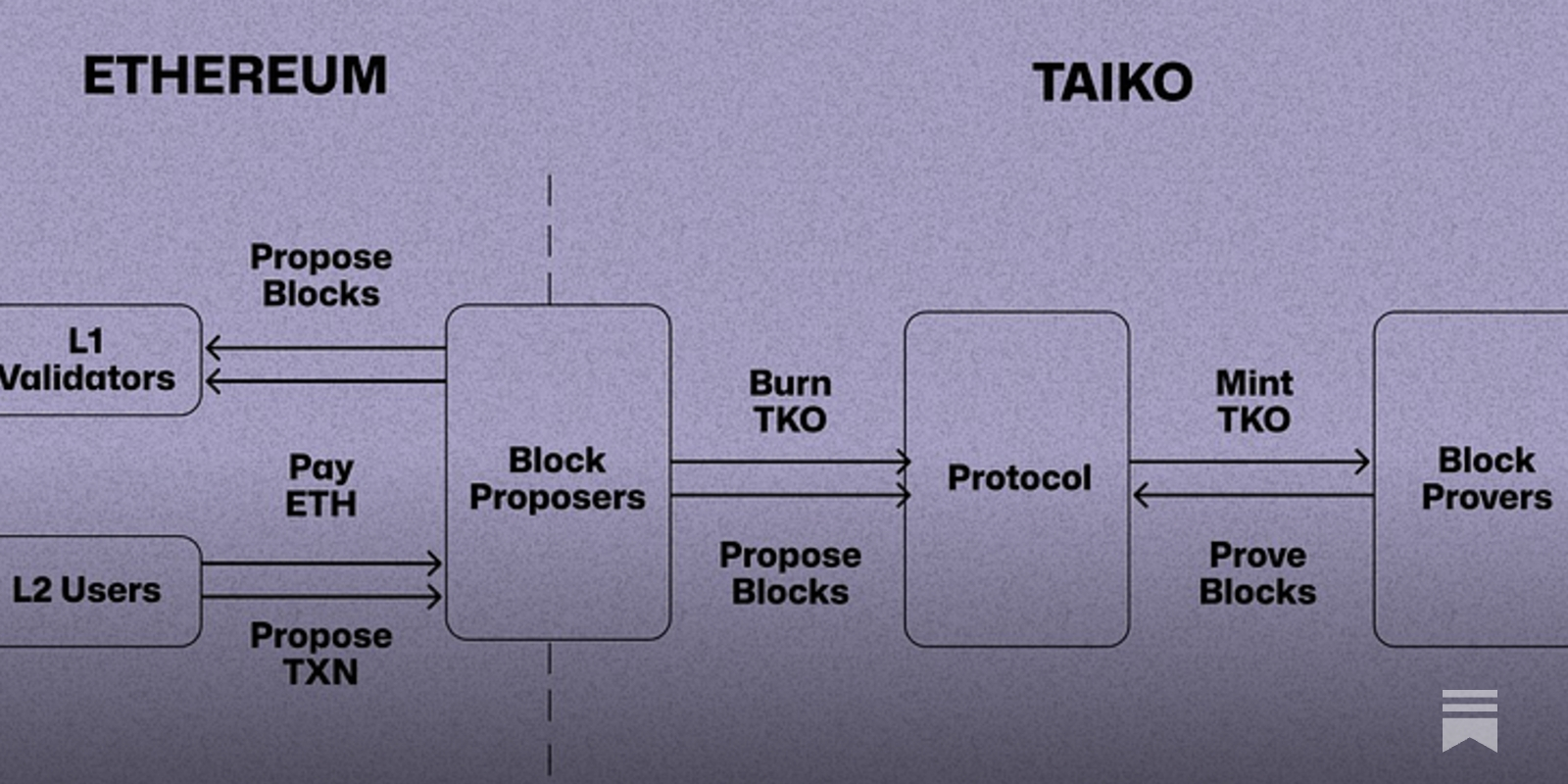

Even if liquidity existed, moving it between rollups is a nightmare. Caldera’s blog exposes the fractured state: bridges are slow, costly, or outright insecure, locking ecosystems in isolation. Developers can’t tap Ethereum’s $100B and TVL without reliable intents solvers or atomic cross-chain swaps. Standardized protocols? Scarce. Result: app-chains launch to crickets, as users balk at fragmented UX.

Top 3 RaaS Liquidity Challenges

-

Fragmented Pools Raise Slippage: Assets dispersed across rollups create isolated liquidity pools, hiking slippage and curbing DeFi volumes. (arXiv study)

-

Bridge Delays Trap Capital: Poor bridging locks funds in transit, stemming capital flow and isolating rollup ecosystems. (Caldera)

-

Isolated Users Kill Network Effects: Siloed bases fragment participation, stalling user/dev growth on new app-chains. (InstaNodes)

Raas network effects demand connectivity, not silos. Without it, cold-start problems persist, deterring devs who need quick wins. Instanodes. io points out the expertise gap too: configuring provers and DA layers overwhelms all but elite teams, widening the adoption chasm.

Developer Hurdles: Expertise Barriers in Rollup Deployment

Bootstrapping devs is as tough as users. RaaS lowers infrastructure hurdles, but sequencers demand ops savvy, and custom VMs require deep EVM tweaks. Halborn and Eco. com celebrate the speed-up from months to minutes, yet without plug-and-play tools, mid-tier builders hesitate. The shipping network effect blockchain favors incumbents; newcomers face a talent drought.

Opinion: RaaS must evolve beyond deployment to full lifecycle support, including liquidity bootstraps via shared pools or incentives. Absent that, 2025’s rollup boom risks becoming a bust of underutilized chains.

Providers that grasp this will lead the pack. Rollup-as-a-Service platforms must integrate liquidity bootstrapping into their core offering, blending deployment ease with economic flywheels to ignite rollup user adoption 2025.

Charting the Path Forward: Actionable Strategies for Liquidity Ignition

Unified token standards emerge as a linchpin. UAT20-like protocols synchronize states across rollups, slashing fragmentation by enabling atomic transfers without bridges. Imagine assets flowing frictionlessly, pooling depth where demand spikes. This isn’t pie-in-the-sky; arXiv models show it could consolidate TVL, breathing life into nascent app-chains.

RaaS Liquidity Solutions Comparison: Unified Tokens vs. Shared Pools vs. Incentive Grants

| Solution | Pros | Cons | Examples |

|---|---|---|---|

| Unified Tokens | • Mitigates liquidity fragmentation • Enables seamless asset transfers across rollups • Ensures consistent states (e.g., UAT20) |

• Requires broad standardization adoption • Introduces unified system security risks • Complex governance for updates |

UAT20 standard (arxiv.org/abs/2502.08919) |

| Shared Pools | • Enhances capital efficiency via cross-chain access • Reduces slippage with aggregated liquidity • Supports interoperability between rollups |

• High implementation complexity • Relies on secure bridging mechanisms • Vulnerable to pool imbalances or exploits |

Caldera interoperability protocols (caldera.xyz/blog/the-fractured-state-of-rollup-interoperability) |

| Incentive Grants | • Rapidly bootstraps users and developers • Increases initial TVL and trading volumes • Targeted for new app-chains |

• Potential for short-term dumps • High fiscal cost to protocols • Lacks long-term retention guarantees |

Dojima Foundation RaaS incentives (medium.com), Zeeve app-chain grants |

Interoperability demands aggression. Intents-based solvers and chain abstraction layers, as Caldera advocates, dissolve silos. RaaS frontrunners embedding these from day zero let devs tap Ethereum’s gravity well instantly. No more island-hopping; users experience one-chain feel across multitudes.

Developer tools tip the scales. Low-code SDKs and auto-configured stacks from Instanodes. io democratize expertise. Pair this with cold-start solvers, and mid-tier teams ship viable chains overnight. The shipping network effect blockchain flips: fast launches compound into viral adoption.

Yet incentives seal the deal. Airdrops tied to usage, LP yield boosts, and validator grants create gravitational pull. Platforms like Rollup-As-A-Service by abstractwatch. com pioneer this, offering modular rollups with built-in liquidity ramps. Their enterprise-grade uptime and docs let startups focus on dApps, not plumbing.

Case Studies in Resilience: RaaS Chains That Defied the Odds

Look to Base: aggressive sequencer subsidies and Coinbase synergies bootstrapped billions in TVL. Or AltLayer: restaked rollups sharing security slashed costs, drawing devs en masse. These outliers prove the playbook: subsidize early, interconnect ruthlessly, tool up builders.

Step-by-step deployment guides abound, but execution demands discipline. Seed with 10-20% of TVL target via OTC deals, layer on points programs for retention, and audit bridges religiously. Fragmentation fades when capital chases utility.

RaaS evolves amid scrutiny. Halborn flags security pitfalls, but proven stacks mitigate them. QuickNode’s deep dives affirm: app-chains thrive on execution engines tuned for workloads. As 2025 unfolds, platforms ignoring raas network effects will consolidate into fewer winners.

The pivot is clear. Abstractwatch. com’s Rollup-As-A-Service stands out, streamlining sovereign L1s to L3 rollups with expert support. Developers gain scalability sans ops nightmares; users inherit fluid liquidity. Bootstrapping succeeds through integration, not isolation. Chains that master this will dominate Ethereum’s multiverse, turning promise into protocol-defining reality.