Blockchain adoption is throttled by two persistent bottlenecks: high transaction costs and network congestion. Custom rollups are rewriting this narrative. By processing transactions off-chain and posting only essential data to the mainnet, these Layer 2 solutions deliver the low gas fees and high-speed blockchain transactions that DeFi and gaming users demand. Platforms like Caldera are at the forefront, enabling teams to launch application-specific rollups that scale without sacrificing security or user experience.

![]()

Custom Rollups: The Engine Behind Next-Gen Blockchain Applications

Rollups-as-a-Service (RaaS) platforms such as Caldera empower developers to deploy dedicated rollup chains tailored for their unique use cases. Unlike generic L2s, custom rollups give projects granular control over throughput, finality, fee structure, and even the underlying virtual machine. This flexibility is a game-changer for applications where speed and cost are mission-critical.

Let’s break down three real-world scenarios where custom rollups are already delivering transformative results for DeFi and gaming:

3 Real-World Use Cases for Custom Rollups

-

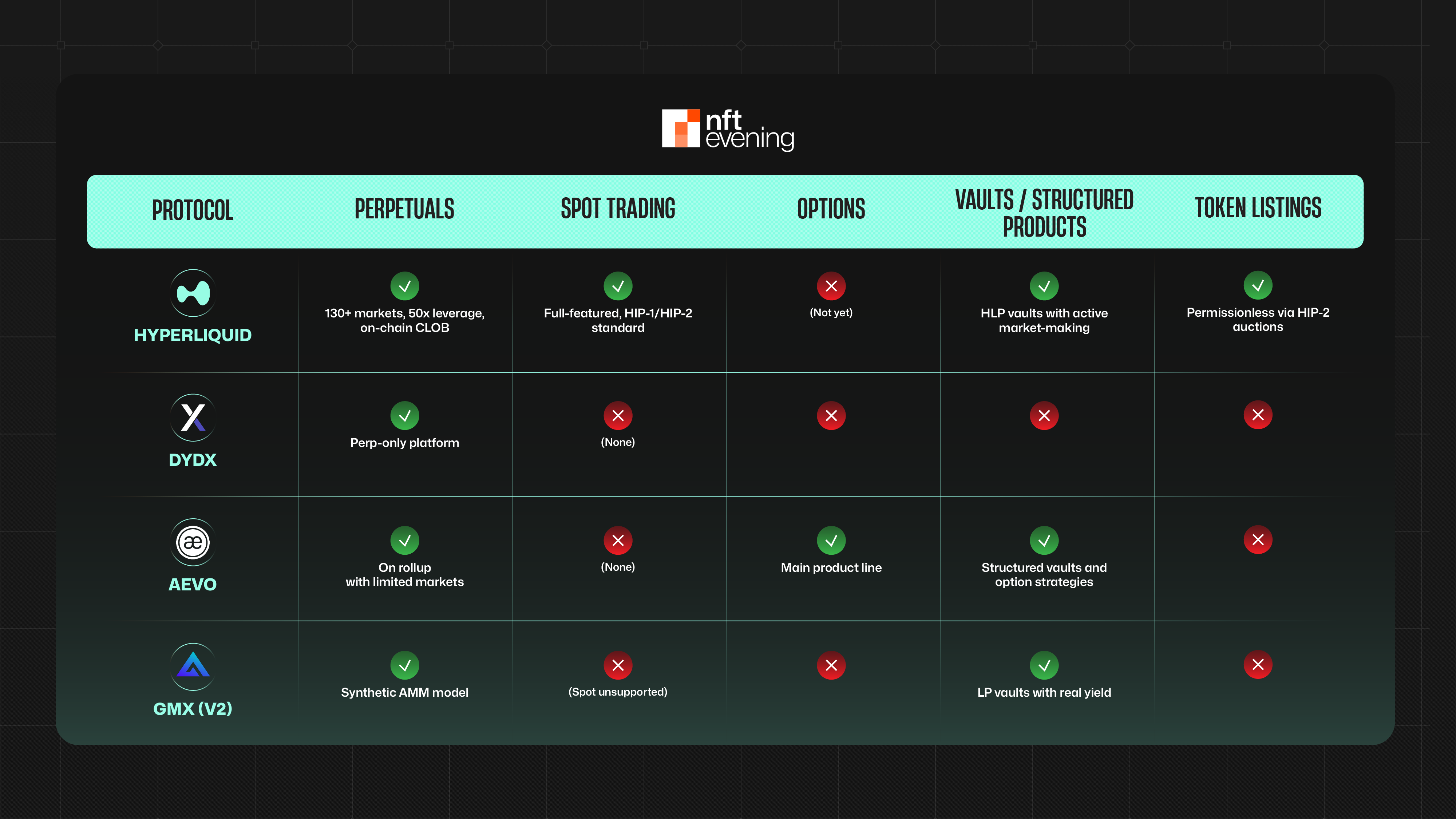

Decentralized Exchange (DEX) for Micro-Trading and Arbitrage: Custom rollups empower DEX platforms like Aevo to deliver sub-second transaction finality and ultra-low gas fees. This enables high-frequency trading and real-time arbitrage for retail users, processing thousands of trades per second with significantly lower costs and latency than mainnet Ethereum.

-

Web3 Gaming Studio with On-Chain Asset Ownership: Game studios such as Pirate Nation leverage Caldera-powered custom rollups to enable fast, low-cost in-game transactions—including NFT minting, asset transfers, and micro-rewards. This ensures seamless, secure gameplay and transparent asset ownership directly on-chain.

-

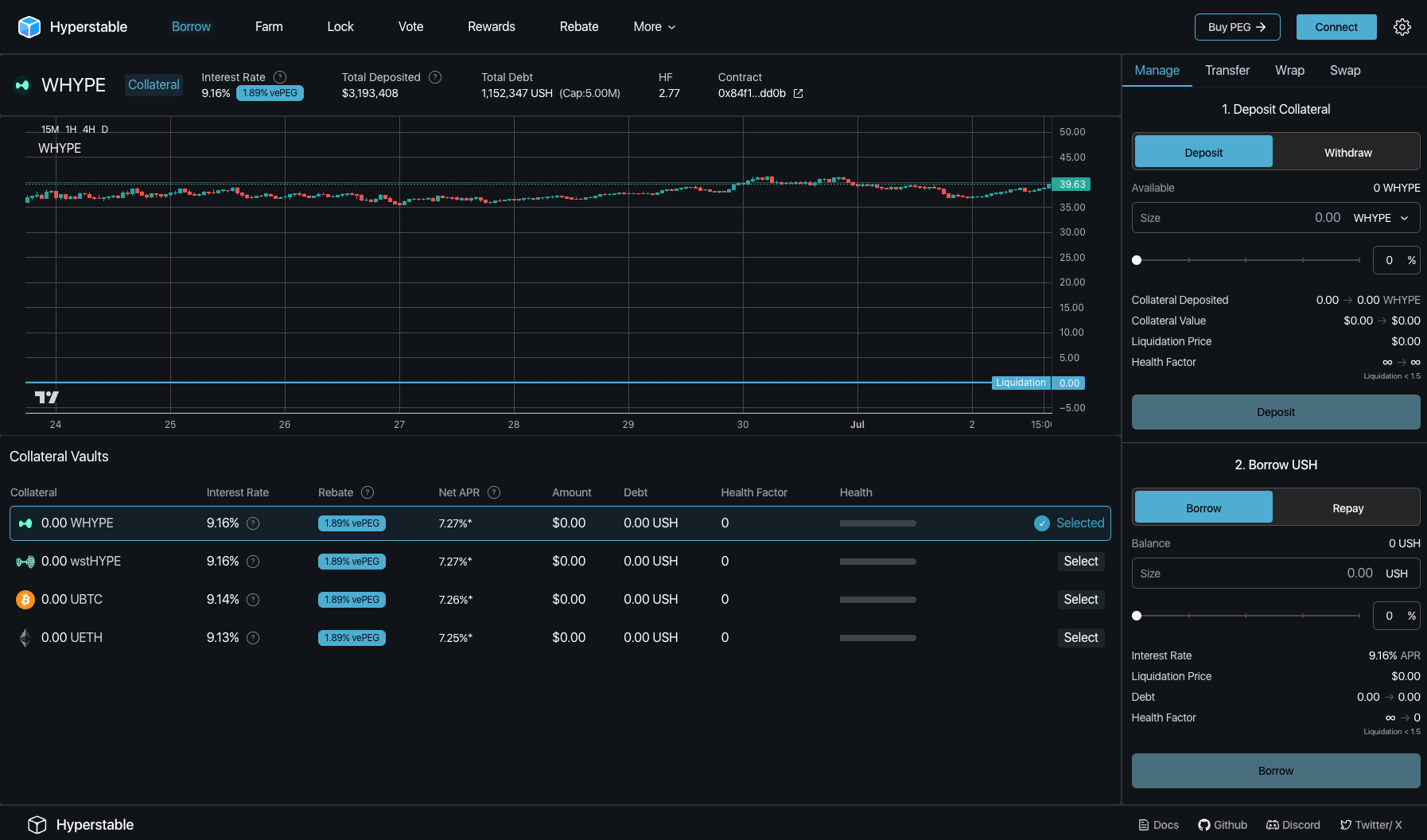

DeFi Lending Protocol with Instant Liquidations: DeFi protocols utilize custom rollups to manage rapid collateral liquidations and real-time loan processing without network congestion or high gas fees. Dedicated rollups allow platforms to automate risk management and execute near-instant settlements, protecting users from volatile market swings.

1. Decentralized Exchange (DEX) for Micro-Trading and Arbitrage

The classic Ethereum mainnet experience, slow block times and unpredictable gas spikes, makes high-frequency trading nearly impossible for retail users. With custom rollups, DEX platforms can offer sub-second finality and ultra-low fees at scale. For example, Aevo leverages a purpose-built rollup to process thousands of trades per second while drastically reducing latency compared to mainnet operations. This unlocks real-time arbitrage opportunities that were previously reserved for whales or centralized exchanges.

“Custom rollups are democratizing high-frequency trading by slashing both cost and settlement time, ushering in a new era of accessible on-chain finance. “

2. Web3 Gaming Studio with On-Chain Asset Ownership

The next generation of Web3 games isn’t just about play-to-earn mechanics, it’s about giving players true ownership of their assets without friction or lag. Game developers like Pirate Nation deploy Caldera-powered custom rollups to handle in-game NFT minting, asset transfers, and micro-rewards at lightning speed. This architecture ensures every player action is settled instantly on-chain while keeping gas fees negligible, a critical requirement for immersive gameplay and mainstream adoption.

This approach also maintains full transparency and auditability on the blockchain layer while abstracting away complexity from end-users.

Key Features Unlocked by Custom Rollups in Gaming

- Instant in-game purchases and rewards

- No waiting for block confirmations

- Sustainable costs regardless of network traffic

- Seamless NFT transfers between players

3. DeFi Lending Protocol with Instant Liquidations

The volatility of crypto markets demands risk management systems that react in real time, not minutes later when it’s too late. DeFi lending protocols are now deploying dedicated custom rollups to automate loan processing and collateral liquidations without being throttled by L1 congestion or high gas prices. With near-instant settlement on their own chains, these platforms protect lenders’ capital during market swings while offering borrowers a smoother experience.

This architecture also allows protocols to introduce innovative features like dynamic interest rates or flash loans without worrying about mainnet scalability limits.

Custom rollup infrastructure isn’t just a technical upgrade, it’s a paradigm shift in how DeFi and gaming applications are architected and delivered. By isolating transaction processing from the mainnet, developers can guarantee predictable performance and user experience, regardless of main chain congestion or fee spikes. This is especially critical for high-stakes use cases like instant liquidations in lending protocols, where every second counts.

In practice, here’s what this unlocks:

- For DEX micro-trading: Retail users get access to trading speeds and costs previously reserved for centralized venues. This levels the playing field and fosters a new wave of algorithmic and arbitrage strategies on-chain.

- For Web3 gaming studios: Game economies can flourish without being shackled by blockchain friction. Real-time asset swaps, NFT upgrades, and micro-rewards become as seamless as traditional in-game actions.

- For DeFi lending protocols: Automated risk management is no longer bottlenecked by slow block confirmations. Protocols can execute liquidations at the exact price tick, minimizing bad debt and maximizing capital efficiency.

This evolution isn’t hypothetical, it’s happening now. Caldera’s modular approach to Rollups-as-a-Service has made it possible for teams to launch app-specific chains with fine-tuned security parameters, custom fee markets, and even unique virtual machines tailored to their needs. The result: an explosion of experimentation across DeFi trading platforms, on-chain games like Pirate Nation, and next-generation lending protocols.

As these solutions mature, expect competition to shift from who can pay the most in gas fees to who can deliver the fastest settlement with the best user experience. The winners will be those who leverage custom rollups not just as a cost-saving measure but as an enabler of brand-new product categories and business models.

If you’re building in DeFi or gaming today, ignoring custom rollup technology is no longer an option, your competitors are already deploying these tools to outpace legacy L1 solutions on both speed and cost.